Maurice Jackson: Welcome to Proven and Probable, where we focus on metals, mining, and more. Today we will discuss a royalty generator, EMX Royalty Corp, trading on the TSX-V symbol EMX and on the New York Stock Exchange symbol EMX. Joining us today is David Cole, the president, CEO and director of EMX Royalty Corp.

Maurice Jackson: Mr. Cole, please share who EMX Royalty Corp. is and what is the thesis you're attempting to prove?

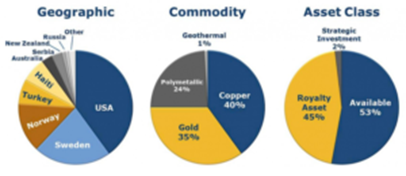

David Cole: EMX Royalty is a royalty company focused on building a global portfolio of gold and copper royalties in addition to other metals such as lead, zinc, cobalt and silver.

Maurice Jackson: EMX Royalty employs what is known as the prospect-generator model. Would you explain what a prospect generator is?

David Cole: I'm quite passionate about the prospect generation business model where we utilize our geological expertise and our business acumen to go forward and acquire prospective mineral rights utilizing technology as leverage. We build a portfolio of prospective mineral rights, we add value by doing good geology and advancing permitting, etc., and then we sell those assets to well-funded major companies and junior companies that we believe will do a good job on our projects. We maintain cash flow coming in from pre-production payments in addition to production royalties on that portfolio.

It's a very powerful way to approach the exploration business giving the shareholders exposure to a substantial optionality across our portfolio.

Maurice Jackson: One of the virtues I really like about the prospect generating model that you've been very successful with is that you de-risk or deleverage the portfolio by using capital from someone else. Expand on that just a little bit.

David Cole: We add value to the early stages, which are intellectually taxing but not typically very expensive. We're able to sell these assets on with the geological models that we've developed on our mineral rights and get other people to spend the money to advance them or we have a tied interest in that optionality. We're exposed to the exploration upside in the discovery potential on these assets as are developed. All at the expense of the counterparty.

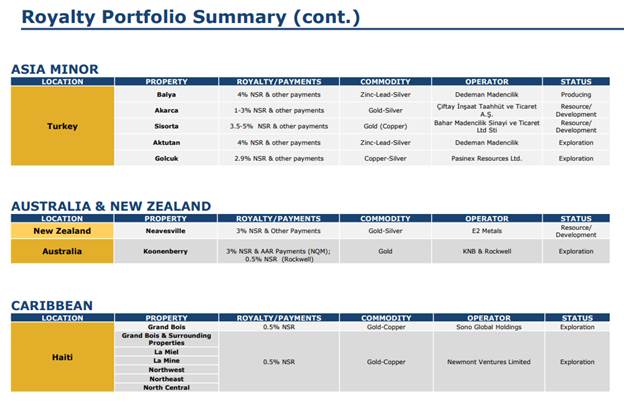

Maurice Jackson: EMX has truly earned the distinction in the natural resource space as being the royalty generator by utilizing a three-point approach. Can you elaborate further on this process, which has been a proven formula for success?

David Cole: I love this combined business model. Specifically, the bread and butter is the organic growth royalty portfolio through the prospect generation business model. But to augment that portfolio that we have grown organically over the course of the last 14 years, we also occasionally find royalties that are available for outright purchase and we've purchased some good royalties that have increased our cash flow and given us greater exposure to some good mineral systems around the world. That's a nice two-pronged approach.

Other royalty companies typically focus only on buying royalties. We focus on organically growing into the prospect generation process in addition to buying them if and when we can find them a good value. I'll say straight up that is a difficult thing to do because royalties tend to trade at a premium and so it's hard to find royalties to buy at accretive pricing, but we're happy to do so when we do find them and there are a couple of good examples within our portfolio. But the fact that they trade at dear valuations is indicative of the value that we're creating through the organic process.

The third prong is strategic investing. The same geologists and businessmen who are out around the world helping us grow our portfolio through the organic prospect generation business model occasionally come across a key specific investment where we can buy shares in a company that is advancing a new discovery around the world. When we're armed with that geological intelligence, we're happy to put some of our shareholders' money to work as a share placement in those companies. We have a good track record of producing some nice returns for our shareholders executing that strategic investment arm. And the three together, in my opinion, very powerful.

Maurice Jackson: You referenced royalties. Let's discuss some past successes of EMX Royalty Corp. How many royalties does EMX Royalty currently have, and where are they located?

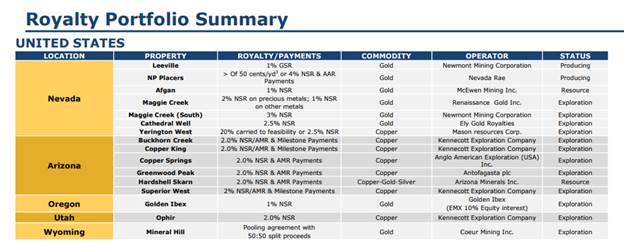

David Cole: We now have a portfolio of 37 royalties around the world focused on copper, gold and polymetallic systems. We have a nice portfolio of gold and copper royalties in the Western United States in the states of Nevada and Arizona, in addition to South Dakota and Washington, but the key assets are in Nevada at this time. That is in addition to some very important royalties that we're developing in Scandinavia focused ultimately on copper and polymetallic systems, including some assets there with cobalt and nickel, which are quite popular right now because of the use of those metals in battery technology.

Some important near-term cash-flowing royalties include royalties in Turkey where we've had an active prospect generation business now for 14 years. And there is a key copper and gold royalty on a massive new discovery in Serbia that's being advanced by Nevsun Resources and that long term will become a company-building royalty for EMX.

If we look at the list, you can see the map with the various colored dots representing our royalties we have around the world and then a list of those royalties. At the top of list is a very important one, Leeville, which is a mine operated by Newmont Mining on the northern portion of the Carlin Trend, one of the most prolific gold producing regions in North America. We're quite pleased to have a 1% royalty there and get checks from Newmont every month. In 2017, this royalty paid US$1.86 million. That's a key risk-reducing and cash line asset for us within the portfolio.

We have a number of Nevada-based and Arizona-based royalties in addition to that, and many of these are being advanced by the counterparties, including Kennecott Exploration Company, which is the operating arm of Rio Tinto Zinc, one the largest mining companies in the world. I would like to point out that we do have some interesting royalties and some of the ones that really drive value are in Europe and Turkey as well. Let's look at some of those.

In Serbia, we have a 0.5% royalty on the big Brestovac discovery that I mentioned. That's copper and gold being operated by Nevsun Resources. We have additional royalties within that complex. It's a geological trend called the Timok Magmatic Complex. It's in Eastern Europe in Serbia and it's the largest historical copper-gold producing region within Europe. The royalties we have there speak volumes to our business model. We were one of the first companies to enter into Serbia, helped it rewrite its money concession legislation and then became substantial landholders there. We sold those off and kept royalties; in addition, we've purchased some other royalties to augment that portfolio, coming back to that idea of multiple prongs to our business model. The long-term potential coming off of this Brestovac license is extraordinary.

We're very pleased with that advancement there. A lot of press releases are coming out on the advancement of the resource both in the lower zone, as well as the opera zone, and the company has a timetable to put that in production, which will be an important moment for the catalysts for revaluation of EMX.

Our team in Sweden has done a fantastic job of executing the organic growth of our portfolio through the prospect generation process by acquiring lots of really interesting mineral rights covering lead-zinc-silver systems, copper-zinc-silver systems, iron and copper systems, cobalt byproducts, and many of these associated with nickel mineralization. For example, we are focused not only in Sweden; we have some very nice assets in Norway as well, and we've been quite successful in getting these sold off via our business model and keeping royalties on those projects. Very importantly, we're also typically paid in shares for many of these, so we're building a portfolio of shares with other exploration companies so that we're able to give our shareholders direct exposure to the exploration and production upsides via the royalty in addition to the excitement of the shares in those companies by giving us the opportunity to win more than once when there is a discovery.

That speaks to this idea of optionality; our shareholders are exposed to optionality with the share portfolio that we have, whether they're strategic investments or shares even paid to us for our properties. In addition to the optionality associated with holding royalties, dominantly that is related to commodity price increases over long periods of time and in addition the exploration and discovery upside to these. Quite importantly, these are typically gross royalties and they cost us nothing to hold. All the work that goes into the ground on behalf of our counterparts Boreal Metals, or Kennecott Exploration, or whoever it is, all of their monies that they spend drilling holes and advancing resources is not to our account. That's other people's money. Those are our counterparties.

We are the royalty holders here and we explore that upside, and so when I discuss the term of optionality and optionality that our shareholders enjoy through this portfolio, that's a good example. Very importantly, we've been in Turkey for 14 years. It's been a very productive prospect generation business unit for us. We've cycled through over 250 licenses in Turkey, and there's now multiple mines being built on our properties. We have a nice income stream coming in from pre-production payments, and production royalty payments just recently started with the lead-zinc-silver mine that Dedeman Madencilik operates that's now producing a royalty for us and we're quite pleased. That's a 4% royalty, which is a very healthy number in the mining industry.

Maurice Jackson: That is quite impressive.

David Cole: It was a very attractive asset and the company that bought that, Dedeman Madencilik, is willing to give us 4% royalty in order to secure interest in the projects so it could advance it. The company has sunk a shaft and is now in production, and we're very pleased to see that and have those production payments coming in. Çiftay, which is advancing the Akarca project where we have a 1-3% sliding scale royalty as production increases over time, pays us 500 ounces of gold as a pre-production payment every six months. That's nice income coming in for EMX shareholders, and we utilize that money to reinvest in our portfolio to acquire more prospective mineral rights around the world.

Sisorta is also a gold discovery with some copper exploration potential at depth being advanced by Bahar Madencilik, and it is doing a good job. We sold off all of the projects that we had in Haiti, which at one point was 1,100 square miles, and kept the royalty. We sold that off to Newmont for US$4 million in cash, which was a nice infusion of cash into our treasury and then kept royalties on those projects.

We've got a couple of good royalties in New Zealand and Australia as well that are gold-focused and with good counterparties that are advancing those projects.

Maurice Jackson: How close is EMX Royalty to becoming cash flow neutral and what is the timeline we should expect to reach this milestone?

David Cole: We were just reviewing our finances for 2017, and when you include devaluation of the shares that we have been paid for our assets that we've sold in Sweden and Norway, now we're actually cash flow positive in 2017, which is a nice milestone for us. We look forward to another good year in 2018. I believe that we will be cash flow positive in 2018 as long as we have a good deal flow, which so far this year has been clicking along nicely and I expect to see additional deal flow throughout the year.

We see very strong interest on behalf of well-funded junior and major companies in the assets that we have around the world, as there has been continued angst within the mining industry that more discoveries are needed in order to feed the global demand for metals. They come to companies like us to look for those properties.

Maurice Jackson: So, another milestone has been reached. You've exceeded being cash flow neutral and are actually cash flow positive.

David Cole: As I said, what put us over the line were share payments, and we do have those shares in our portfolio. We do from time to time liquidate those shares, to convert those to cash so we can redeploy those monies into our portfolio and execute our organic model.

Maurice Jackson: Would you share with us some of the counterparties that EMX has?

David Cole: We've had the opportunity of working with some very well-funded and astute mining companies around the world. Topping the list would be Newmont, which operates our Leeville mine royalty, and we're happy to get checks from it every month, but we're also happy to see its expertise employed on that project. Newmont does an excellent job in continuing to find more mineralization. It's also the company that we sold all of our assets in Haiti to and kept a royalty on those projects.

We have ongoing communication with Newmont. It's also a shareholder; it owns around 5.5% of EMX. Another company that we have done repeat business with is Rio Tinto, the world's largest mining house. We've done six deals in the course of last four years with Rio Tinto. We have ongoing work and programs with it and continue to have discussions about possible new deals. It's a pleasure for us to have a chance to work with the behemoth Rio Tinto and that speaks to the credibility of our geologists, such as Dr. Eric Jensen in Northern Europe and Dr. David Johnson in the Americas. Companies like Rio Tinto want to work with us because of the expertise that these economic geologists have.

Freeport-McMoRan, the largest U.S. copper company, is our partner in Russia where we have a strategic investment and are advancing in a substantial copper-gold discovery there in far southeastern Russia.

Nevsun Resources is a well-funded aggressive junior mid-tier. It's not a junior, it's actually a mid-tier resource company focused on base metal and gold production. It is advancing the Timok project, the Brestovac license in Serbia that we talked about previously, and we're happy to have Nevsun on the list.

Antofagasta, which is a major copper producer dominantly in South America, has about a $20 billion market capitalization. We've done multiple deals with Antofagasta; it's also a small shareholder in EMX, about 3%. We've been quite pleased to have an ongoing relationship with it with repeat business.

I'd like to point out that Arizona Mining is a new company focused on the discovery of a large base metal, lead, zinc, and silver deposit in Arizona. That, and we have a royalty on some of its claims that have been released from us and we're delighted to see its expertise.

Boreal Metals Corporation is a new public company focused on advancing battery, metals, and base metal opportunities in Northern Europe. We're large shareholders in Boreal; we own over 19% of that company, thanks to the deals that we have done with it, where we've sold to it different assets in exchange for shares, cash payments and royalties. I believe that Boreal is going to do very well. It completed some projects in Sweden recently, produced some quite nice results and was very pleased.

This gives you an example of a number of the companies we've worked with. I'll say that over the course of 14 years of executing this business, we have worked with a lot of different companies. We have the pleasure of their monies being spent on our properties, but we also have the pleasure of seeing their expertise, whether it's geophysical, geological, social expertise with regards to permitting, etc. All of these things add value and give that optionality that keeps coming back to our shareholders.

Maurice Jackson: Take us through the asset portfolio and let's look at projects that may join the royalty portfolio.

David Cole: This is the global map of the EMX's assets around the world. This includes our royalties, and in addition to the projects that we're advancing and marketing and trying to sell off and to continue to grow our royalty portfolio. We've been very active in the Western United States, particularly in the copper belts of Arizona and in the gold belts of Nevada where we have a large number of mining claims. We now have over5,000 active mining claims in the Western United States, making us one of the larger mining claimants in the region.

Another area of the world where we have focused organic growth and where we continue to be aggressive with regards to acquiring new projects based upon our geological expertise is Northern Europe and Norway and Sweden. There we are looking at polymetallic systems that have zinc, lead, copper, or nickel copper and cobalt, metals that are in big demand right now. We see a strong appetite from those that wish to invest in the exploration business in our projects in Sweden right now, which is a great position to be in.

We talked about the royalty portfolio that we have in Serbia and Turkey. We're happy with those royalties. We're currently not doing much new acquisition in those countries. We're focusing our new acquisition in Northern Europe and the Western United States.

Maurice Jackson: I realize that EMX Royalty is not biased to any one project in its asset portfolio, but I have to share that I am. What can you share with us regarding Malmyzh?

David Cole: Malmyzh is one of the larger ongoing copper-gold discoveries in the world. It's being advanced by the private company IG Copper. EMX owns 42% of the issued and outstanding share capital of IG copper and IG Copper is in joint venture with Freeport-McMoRan. We've found a number of copper-gold deposits along a belt there that's a substantial asset within our portfolio, and it was recently announced that we have signed up Scotiabank, one of the largest banks focused on natural resource investing in the world, and we have it in our camp now and it is helping us decide on what the right business initiatives are for that project.

Maurice Jackson: The location is the green diamond on the map below.

David Cole: This is extreme southeastern Russia on the Amur river. That's in close proximity to a number of smelters. Korea, Japan, and China all have smelters at waterfront. The deposits at Malmyzh lie in close proximity to a railroad in addition the Amur River where you can barge concentrate down river to the Sea of Okhotsk and around to the Sea of Japan to access those smelters. This is a region of the world that has very significant copper demand.

Maurice Jackson: Switching gears, let's talk numbers. How much cash and cash equivalents do you have in the treasury?

David Cole: Right now, we're sitting with about CA$5 million in cash and shares in other companies. Most of those shares have been paid to us for deals we've executed in the recent past. That does not include the share position that we have in IG Copper. That's a private company so it's not included.

Maurice Jackson: How much debt do you have?

David Cole: We do not have any debt. I would typically execute our business model without taking on debt.

Maurice Jackson: What is your burn rate?

David Cole: We actually have cash flow, as we discussed previously. When you take a look at all the royalty payments we have coming in, pre-production payments, lease payments associated with projects that we're in the process of selling, in addition to the share payments that have come in associated with sales of assets, we're cash flow positive in 2017.

I believe that we'll continue on that trend to be cash flow neutral to cash flow positive as we move in 2018. And that's a key event for us because that means we've created now a perpetual motion machine where instead of continued need to raise money by issuing shares, we will have the monies coming in from the sale of shares, and from royalty payments, and lease payments, and advance minimum royalty payments, all sorts of different payments that we've designed into the deals we've executed over time so that we have money coming in to fund the continued acquisition of prospective mineral rights around the world.

That's a key threshold for us to be at a point where the portfolio is funding additional land grabs and mineral rights grabs around the world to fuel our exposure to mineral upside.

Maurice Jackson: What is the current price?

David Cole: We're currently trading at around a CA$1.11 per share in the Toronto Stock Exchange, and US$0.89 per share on the New York Stock Exchange.

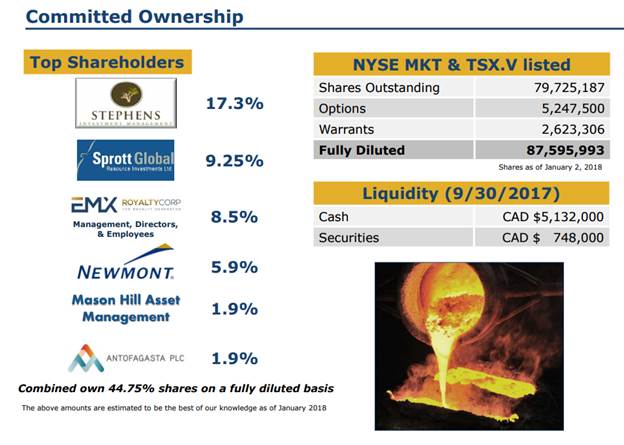

Maurice Jackson: Tell us about your share structure, which includes warrants, options, and all the fully diluted.

David Cole: We have 77 million shares issued and outstanding. I believe we have about 83 million shares fully diluted by the time you consider the options and a few warrants are also outstanding on the stock at this point in time.

Maurice Jackson: Who are your major shareholders?

David Cole: In addition to Newmont, which owns about 5.5% percent, and Antofagasta, which owns a few percent, we do have some key strategic shareholders and that would include Paul Stephens, a very successful fund manager. Paul manages mostly his own money and the money of himself and some friends in a couple of different funds. They collectively have 18 or almost 19% of EMX; they're our largest single shareholder. They believe in our combined business model approach. They fully understand the optionality that we're creating for our shareholders through the exposure of discovery that's ongoing on the assets around the world. Paul's been a long-term shareholder and he continues to buy more shares. He's been buying more shares for years.

Maurice Jackson: What percentage does management ow?

David Cole: I believe in a fully diluted basis, we're around 12% right now. That number has been going up and there has been substantial insider buying both on behalf of Paul Stephens and myself. I've been buying the stock periodically over the course of the last three years. That speaks volumes with regards to our attitude as to what potential the company has in it.

Maurice Jackson: When was the last time you purchased shares in the last three years, and what was the price?

David Cole: I do not remember the last time that I purchased, but it was a handful of months ago. It would have been in the US$0.70 or US$0.80 range. All of our trades, of course, are reported. Those are available on the SEDAR website that has everybody's trades and you can go there and research that, and see those insider purchases, which have been occurring consistently over the course of last three to three and a half years.

Maurice Jackson: In closing, what is the next unanswered question for EMX Royalty? When should we expect an answer? And what determines success?

David Cole: More cash in our treasury and more cash flow from our royalties is the ultimate measure of our success. When we have 80-some projects worldwide and 37 royalties, these unanswered questions here can come from multiple avenues. But we're very pleased with the deal flow that we continue to enjoy across the portfolio, and, of course, I would like to highlight your favorite project, which is Malmyzh in far southeastern Russia, and our engagement with Scotiabank to help us with our business initiatives there.

This could be very interesting to see what business initiatives are recommended by Scotiabank and how we can execute on those over time. I believe that can be a catalyst for repricing EMX in the marketplace.

Maurice Jackson: What keeps you up at night that we don't know about?

David Cole: I have some fantastic people on board here that are contributing to help build this portfolio. We're on the road a lot, traveling, working hard in remote regions, and I'm most concerned about their safety and well-being.

Maurice Jackson: What did I forget to ask?

David Cole: You're very thorough, and you've got a good understanding of our portfolio and I appreciate that. I appreciate the fact that you are a shareholder in the company. One of the key aspects that drives our share price is the role of commodity prices, and that's something that, of course, we have no control over, but it's something that we have to manage.

We try to very much understand that it's a quite cyclical business and one of our key strategies around that cyclicity is to be aggressive in acquisition of prospective mineral rights during downturns and then available as projects to capable mining houses as the market recovers. That's a key component to long-term shareholder value creation with EMX. I oftentimes field questions about where I think commodity prices are going, but, of course, I don't have a crystal ball. But what I can elaborate on is what our ongoing strategy is.

We just recently came off a period of substantially reduced commodity prices and we took full advantage of that, acquiring a substantial number of new prospective mineral right properties around the world. And now we're seeing a modest recovery with strong interest from a lot of customers. I'm more than happy to sell these off and continue to grow that portfolio of royalties.

Maurice Jackson: If investors wish to give more information regarding EMX, please share the contact details.

David Cole: Emxroyalty.com is a great place to start on that website, but also the phone numbers where you can reach Investor Relations and call up and talk to us. We'd love to talk to shareholders and prospective shareholders about the advancement that we have on various assets around the world whether they be battery metal related, precious metal related, or base metal related.

Maurice Jackson: For our readers, for Investor Relations, Scott Close will be your point of contact, and his phone number is 303-973-8585.

David Cole of EMX Royalty Corp, thank you for joining us today on Proven and Probable.

David Cole: Thank you, Maurice.

Maurice Jackson: Last but not least, please visit our website www.provenandprobable.com where we interview the most respected names in the natural resource space. You may reach us at [email protected].

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) David Cole: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: EMX Royalty Corp. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: EMX Royalty Corp.

2) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: EMX Royalty Corp. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: EMX Royalty Corp. is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

3) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

4) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

5) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this interview, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Nevsun Resources, a company mentioned in this article.

Images provided by the author.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. YOU SHOULD NOT MAKE ANY DECISION, FINANCIAL, INVESTMENTS, TRADING OR OTHERWISE, BASED ON ANY OF THE INFORMATION PRESENTED ON THIS FORUM WITHOUT UNDERTAKING INDEPENDENT DUE DILIGENCE AND CONSULTATION WITH A PROFESSIONAL BROKER OR COMPETENT FINANCIAL ADVISOR. You understand that you are using any and all Information available on or through this forum AT YOUR OWN RISK.