Drilling at Dean claystone project; Clayton Valley, Nevada

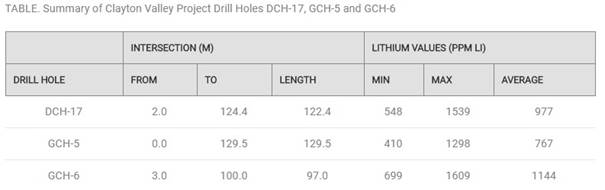

After completing its drill program, Cypress Development Corp. (CYP:TSX.V; CYDVF:OTC.MKTS; C1Z1:FSE) is on track to deliver the maiden resource estimate for the Dean and Glory projects before the end of this month. The latest results, published on April 3, 2018, provided very strong showings for the northern part of the Glory project, likely adding more tonnage than expected here. Intercepts included an intersection of 97 meters averaging 1,144 ppm Li in the final hole, GCH-6, along with intersections of 122.4 meters averaging 977 ppm Li in DCH-17 and 129.5 meters averaging 767 ppm Li in GCH-5. All three holes show consistency in encountered Li grade with the previous 20 holes drilled on the Dean and Glory properties.

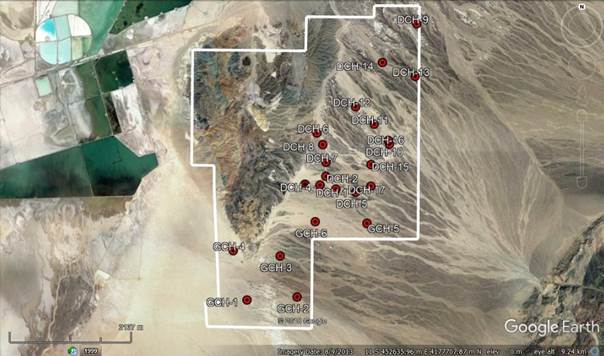

Below is a map of the drill collar locations for both Dean and Glory:

Dean & Glory projects, Clayton Valley, Nevada; drill collar locations

Mineralization starts almost from surface, as can be seen in this table of latest drill results:

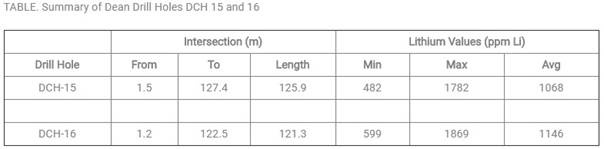

Following this is a table of the highlights on Dean/Glory released at March 13, 2018, indicating great consistency in mineralization and low strip ratio:

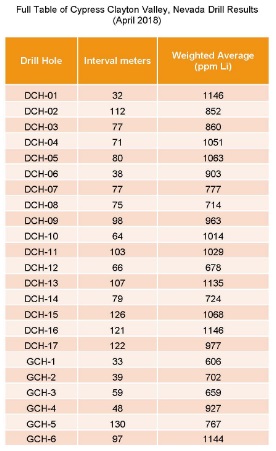

These results are again completely in line with the earlier reported assays on Dean and Glory, and therefore increase my confidence in continuity, and therefore the chance on a substantial resource. According to management, all drill holes ended in mineralization, which averages at about 300ppm Li. Here is a table with all drill results of the completed drill program:

It will be clear that the Glory results can't match the Dean results for thickness and/or grade except GCH-5 and GCH-6, but these ones are very close to the Dean property border so that's probably no coincidence, and therefore Glory likely just represents a nice add-on to Dean.

To see where these results could lead to, I revised my earlier estimates on the two projects. Average grade and size actually slightly increased, but it appeared after talking to management that the specific density/gravity was lower than assumed by me in earlier updates, so the total tonnage comes in slightly lower as well, but still world class.

The Western Flank is estimated at 900 ppm Li average, 5,000m long, 750m wide and 70m thick, resulting in a 262.5M m3 envelope, using a gravity of 1.7t/m3 this time resulting in an envelope of 446.25Mt, containing a hypothetical 2.4Mt LCE.

The Higher Grade Zone is estimated at 1050 ppm Li average, 3,500m long, 1,000m wide and 80m thick, resulting in an envelope of 476Mt, containing a hypothetical 2.5Mt LCE.

For the Glory project I revised my estimate after the latest results, to an average grade of 800ppm Li, 1,000m long, 1,500m wide and 50m thick, resulting in an envelope of 127.5Mt, containing a hypothetical 0.55Mt LCE.

Adding it all up, I would arrive at a newly estimated target of 5.45Mt LCE. As my estimates are premature, my preferred target margins would be about 5-6Mt.

Again, as a reminder, examples of world class sized LCE deposits in each category are brine projects like Cauchari/Olaroz (Orocobre: 6.4Mt LCE, SQM/Lithium Americas 11.7Mt LCE), clay projects like Sonora (Bacanora: 7.2Mt LCE) or hard rock projects like Whabouchi (Nemaska: 4.06 Mt LCE).

It seems like the size of the Dean/Glory resource will be fine. In the meantime, the company is working hard to achieve a commercial extraction/recovery method, and, according to management, results are very promising. Recovery has been raised from 74% to 80% now, the temperature has been lowered from 80C to 50C and the amount of acid consumption has been brought down from 140-170kg per tonne of material to 100kg/t now, where 140-170kg/t was already considered a commercial figure. The next step will be focusing on the separation of lithium and contaminants, in order to produce a viable concentrate.

Cypress Development is working hard on the maiden resource estimate, scheduled to come out in a few weeks, and very shortly after that it will initiate work on a Preliminary Economic Assessment (PEA). The treasury currently contains about C$700k, and management estimates it needs about C$100k to complete the resource estimate, and C$250k for the PEA, so there is no need for a financing soon. This PEA is scheduled for completion in August or September of this year, which is earlier than I expected.

Management just did a first road show in the U.S. for a group of retail investors, fund managers, brokers and analysts, and they received very positive feedback, which bodes well for future financings. A subject that will undoubtedly help in this regard is the setting up of the OTCQB listing, which will be finished the next few weeks, and the company expects trading in the U.S. to commence before the end of April 2018.

The upcoming maiden resource estimate will likely establish a world class sized resource, and will undoubtedly put it firmly on the radar of big players. If met work keeps delivering consistent results and achieves successful separation and commercial recovery on a commercial scale, the sky is the limit for Cypress Development. As I estimated in another update earlier on, a $500M-1B NPV for this resource size and grade isn't unrealistic IF economic, however, the current market cap is just C$13.57M. This could be an interesting summer.

Lithium bearing claystones at Glory project; Clayton Valley, Nevada

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at http://www.criticalinvestor.eu/, in order to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

Disclaimer:

The author is not a registered investment advisor, and has a long position in this stock. Cypress Development is a sponsoring company. All facts are to be checked by the reader. For more information go to Cypress Development Corp. and read the company's profile and official documents on Sedar, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Want to read more Energy Report interviews and articles? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.