I wrote about Silver Bull Resources Inc. (SVB:TSX; SVBL:NYSE.MKT) back in November. The stock was unloved and hovering at $0.11 a share. I suggested potential investors watch for news releases because the company has totally changed direction. Since then the price of silver has been pretty much unchanged but Silver Bull has doubled.

We found a new young writer recently who has been generating some valuable information about various investing issues. Recently he wrote a piece about silver that uses a different approach to say what I have been trying to say for a year. Silver is cheap and as I said in my book, you should buy cheap and sell dear.

As I write, the ratio between silver and gold is 81.23 ounces of silver to buy one ounce of gold. In Kevin's article he clearly shows how the return on silver is far higher if you buy silver when the ratio is above 80:1. Silver is cheap and Silver Bull is even cheaper.

While the "Experts" are mumbling about how JPM is manipulating silver with the biggest short position since Christ was a Corporal, my readers are making money. The "Experts" have been wrong with everything they have said about silver for 20 years that I have followed them. If you are a real "Expert" you really should get something right once in a while. These idiots have no idea of what JPM is doing with silver any more than you or I do.

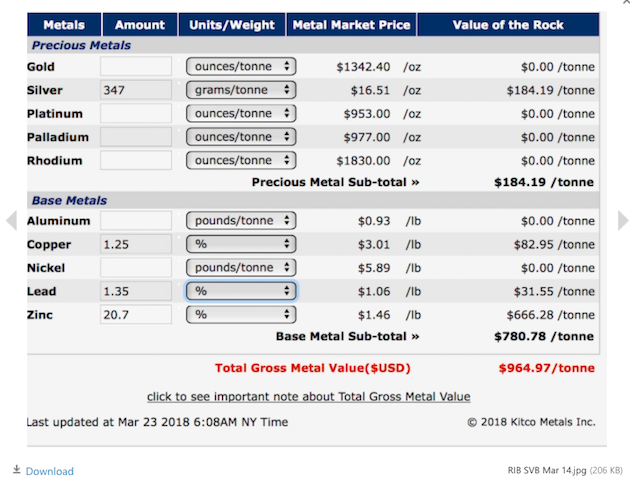

On March 14th Silver Bull released assays from the last three drill holes at their Sierra Mojada project in Northern Mexico. The best hole was 10 meters of $964 rock. That's a home run hole and the other three holes were shorter but almost the same grade.

Sierra Mojada has an existing 43-101 showing 90 million ounces of silver and 4.67 billion pounds of zinc but there is serious environmental and safety issues working oxide zinc and especially lead. The market didn't like that so SVB lost 80% of its value between 2011 and today.

Company president and CEO Tim Barry changed direction in 2017 and began to drill the sulfide resource that he knew was underneath the oxide mineralization. His aim was to delineate a high-grade sulfide resource that works with current processes of working sulfide silver, lead, zinc deposits. His theory worked and the market moved the Silver Bull shares from a low of $0.035 in January up 550% to today's price.

In 2018 Silver Bull intends to step out and drill the Paloma Negros prospect 9 km along strike from the main Sierra Mojada deposit. Historical drill results from the 1950s from Penoles show sulfide mineralization up to 10 meters with similar +18% combined lead and zinc.

Drill results will continue to be released and I expect the market to revalue Silver Bull as more sulfide assays are released. The next giant step forward will naturally be a revised 43-101 showing the sulfide resource but that could be up to a year down the road.

Silver is very cheap now and with the increasing chaos both politically and financially, I expect all of the precious metals to go higher. But especially silver and platinum. They are very cheap. A tailwind from the price of silver will return SVB to the higher market cap it once enjoyed.

The company is a pleasure to work with and certainly they do a wonderful job of keeping me up to date. They have an excellent presentation all potential and actual investors should read. They do what they say they are going to do and I value that a lot.

Silver Bull is an advertiser and I do own shares. Please do your own due diligence.

Silver Bull Resources

SVB-T $0.225 (Mar. 23, 2018)

SVBL-NYSE 200 million shares

Silver Bull website

Bob and Barb Moriarty brought 321gold.com to the Internet almost 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Read what other experts are saying about:

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Silver Bull Resources. Silver Bull Resources is an advertiser on 321 Gold. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned are billboard sponsors of Streetwise Reports: Silver Bull Resources. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Silver Bull Resources.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Silver Bull Resources, a company mentioned in this article.