South32 Ltd. (S32:ASX) has the distinction of owning the giant Cannington Mine, the world's largest and lowest cost producer of both lead and silver, which is good to know, since we are of the opinion that silver is at a very low price and is an extremely good value investment here. The company is also a very big producer of other base metals, but as far as is known has not yet discovered any unobtanium. The stock charts only go back about 3 years because the company was spun off from BHP Billiton several years ago.

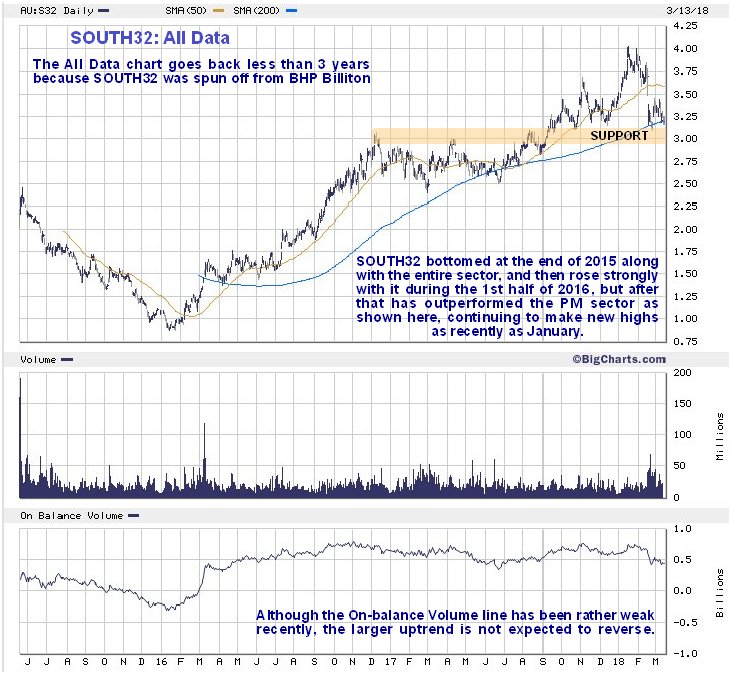

On the all data chart which goes back to mid-2015 we can see that after being spun off, South32 continued to drop in a severe downtrend in sympathy with a weak sector, until it hit bottom in January 2016. It then reversed into a strong uptrend, again in sympathy with a now strong sector, but while the sector advance stopped and reversed in August 2016, South32 carried on to higher levels until December 2016, and then ran off into a long consolidation pattern that ended with an upside breakout the following September. This quite strong upleg continued until January and last month it reacted back to its rising 200-day moving average and to a point not far above the support level shown, where it is suspected to be forming an intermediate base pattern, because the rising 200-day moving average is an indication that the trend is still up, and this factor is thought to override the rather weak On-balance Volume line in the recent past, especially because of the now positive outlook for gold and particularly silver.

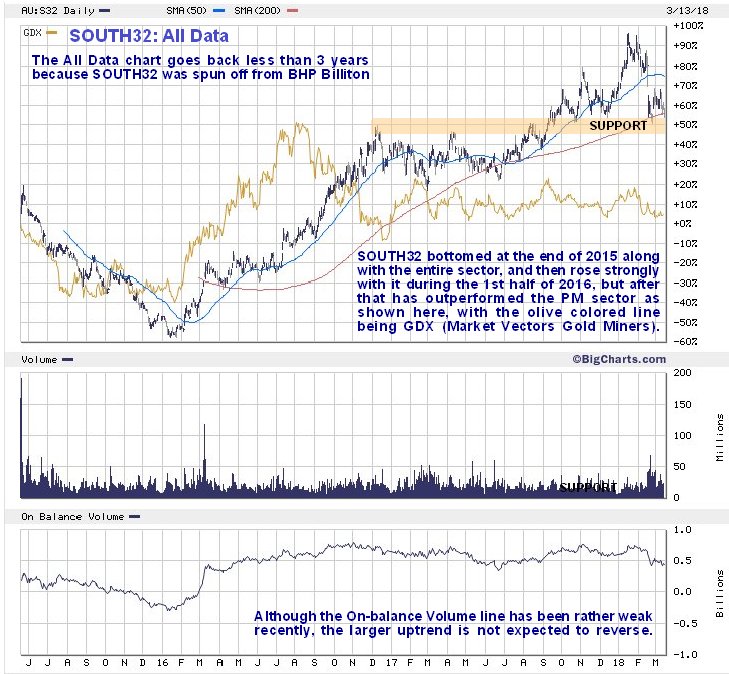

The following chart is the same all data chart as the one above, but with the Market Vectors Gold Miners ETF, GDX, overlayed, so that the performance of South32 can be compared with the performance of the PM sector as a whole. As we can see, it moved with it until the Summer of 2016, but after that South32 outperformed significantly, which is all the more impressive given the drab performance of silver over the past year or two.

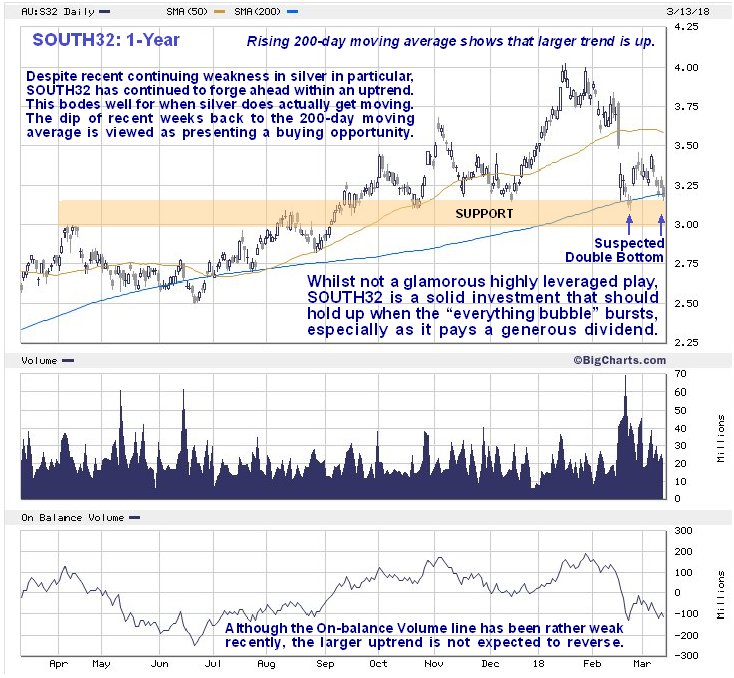

On the 1-year chart we can see recent action in rather more detail, in particular how the reaction back from the January high has presented a better entry point. The still rising 200-day moving average and proximity of strong support indicate a high probability that it will turn up from this area, and it is currently believed to be making a small Double Bottom with its late January low, that will lead to another upleg.

The number of shares in issue is a daunting 5.2 billion, but that doesn’t seem to have slowed it down, probably because it is a mining company whose output of silver and base metals is on a truly gigantic scale.

A preliminary search for the company's website turned up what I at first thought was a social or welfare club. When you enter it you find yourself on a website that is wonderfully politically correct, and for example it is easier to find information on the company's anti-slavery policy than it is to find information on production and the company appears to be almost apologizing for mining as in "Look, we have to make these big holes in the ground, so that you can have metals for your cars, iphones and washing machines etc” – it's enough to make an old school miner cringe – wonder what Crocodile Dundee would have to say about it?

Back to South32, while the company’s website may portray it is as a social club and a fun place to work, the underlying reality is that they “produce the goods” and in vast quantities, and in a world in which many companies produce nothing of any substance, it represents a solid investment at a time when commodities look set to move to the forefront and become one of the best performing sectors.

South32 is thus rated as a solid investment here for the future, that is at a good entry point after its recent dip. The company's stock also trades on the London Stock Exchange in big volumes and the Johannesburg Stock Exchange.

South32 website

South32 Ltd, S32.ASX, S32.LSS, closed at A$3.18 on 13th March 18, trading at 181.10 at 2.53 pm GMT on 13th March 18.

Stay tuned – for upcoming reports on neighboring South31 and South33.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Want to read more Streetwise Reports articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Clive Maund: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. CliveMaund.com disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.