In a March 1 research note, National Bank of Canada analyst Shane Nagle reported that he initiated coverage on Trevali Mining Corp. (TV:TSX; TV:BVL; TREVF:OTCQX) with a Sector Perform rating and a 12-month, per-share target price of CA$1.90. This compares to CA$1.44 per share, where the stock is trading today. He highlighted that Trevali is "nearly a Top 10 zinc producer globally and with US$190M in annual free cash flow at current prices has the ability to build upon its existing portfolio."

Nagle presented these four key reasons to own the company:

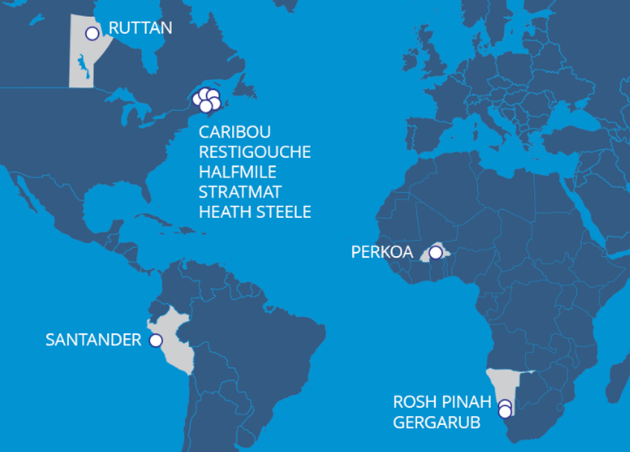

1. Trevali has a significant operating portfolio. The 2017 acquisition of Perkoa in Burkina Faso and Rosh Pinah in Namibia and some exploration targets shifted the company, Nagle pointed out, "from a small-cap zinc producer to an emerging global producer with four operations in four separate countries."

2. Trevali has exposure to zinc and a rising zinc price. The latter increased more than 140% from its most recent nadir in early 2016 of $0.66 per pound, explained Nagle. "Being a primary zinc producer, the company shows heightened sensitivity to zinc prices versus its peers."

3. Trevali has free cash flow, which it can use to repay debt and fund exploration, resource expansion and acquisitions. This cash flow comes from the newly acquired mines and from an elevated zinc price. "We believe Trevali is well positioned to eliminate net debt by mid-2018 and focus on delivering its growth mandate through greater near-mine and regional exploration," stated Nagle.

4. Trevali has exploration upside. Focused on expanding the mineral resources near its existing mines to extend their life, the company outlined for 2018 a 60,000 meter (60,000m), US$10 million drill program. It includes 21,000m of drilling at Santander in Peru, 17,000m at Perkoa, 12,000m at Rosh Pinah and 10,000m at Caribou in New Brunswick, Canada. Nagle indicated, "With the company's accelerated growth initiative, including the ongoing near-mine exploration programs at all four of its producing operations, we expect additional resources to lead to mine life extension/expansion opportunities."

Read what other experts are saying about:

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Trevali Mining. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Disclosures from National Bank of Canada Financial Markets, Trevali Mining Corp., Initiating Coverage, Mar. 1, 2018

Research Analysts – The Research Analyst(s) who prepare these reports certify that their respective report accurately reflects his or her personal opinion and that no part of his/her compensation was, is, or will be directly or indirectly related to the specific recommendations or views as to the securities or companies.

NBF compensates its Research Analysts from a variety of sources. The Research Department is a cost centre and is funded by the business activities of NBF including, Institutional Equity Sales and Trading, Retail Sales, the correspondent clearing business, and Corporate and Investment Banking. Since the revenues from these businesses vary, the funds for research compensation vary. No one business line has a greater influence than any other for Research Analyst compensation.

All of the views expressed in this research report accurately reflect the research analysts’ personal views regarding any and all of the subject securities or issuers. No part of the analysts’ compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in this research report. The analyst responsible for the production of this report certifies that the views expressed herein reflect his or her accurate personal and technical judgment at the moment of publication. Because the views of analysts may differ, members of the National Bank Financial Group may have or may in the future issue reports that are inconsistent with this report, or that reach conclusions different from those in this report.

Additional Company related disclosures for Trevali Mining Corp.:

National Bank Financial Inc. has acted as an underwriter with respect to this issuer within the past 12 months.

National Bank Financial Inc. has provided investment banking services for Trevali Mining Corp. within the past 12 months. National Bank Financial Inc. or an affiliate has managed or co-managed a public offering of securities with respect to Trevali Mining Corp. within the past 12 months. National Bank Financial Inc. or an affiliate has received compensation for investment banking services from Trevali Mining Corp. within the past 12 months. Trevali Mining Corp. is a client, or was a client, of National Bank Financial Inc. or an affiliate within the past 12 months.