On February 20, Seabridge Gold Inc. (SEA:TSX; SA:NYSE.MKT) announced that it has begun a 36-hole, 7,200-meter program using two core rigs at its 100%-owned Courageous Lake Project in Canada's Northwest Territories. The program is being conducted to test seven separate targets.

Nearly all of the 53-km-long Mathews Lake Greenstone Belt (MLGB) is covered in the Courageous Lake Project. The Felsic-Ash-Tuff (FAT) deposit owned by Seabridge is part of this area; a 2012 estimate found 6.46 million ounces of proven and probable gold reserves are contained in the FAT deposit.

A campaign to increase Courageous Lake's mine life resulted in the discovery of the Walsh Lake deposit in 2013. A 2014 surface Inferred resource estimate of 482,000 ounces of gold (4.6 million tonnes grading 3.24 g/t) at Walsh Lake was confirmed by an independent resource expert.

According to Seabridge Gold, "the Walsh Lake deposit could be mined prior to constructing the processing plant required for the larger, refractory FAT deposit. This order of development could have significant economic benefits for the Courageous Lake project not only by extending mine life but also by generating cash flow to pay for some capital costs as the FAT deposit ramps up."

"More Walsh Lake-style deposits added to the front end of the FAT Deposit revised mine plan could have a significant positive economic impact. These seven targets have been carefully selected on the basis of historical data and our own mapping and geophysical work which clearly shows that they are in the same geological setting as our Walsh Lake discovery," said Seabridge Chairman and CEO Rudi Fronk.

While speaking with Streetwise Reports after the drilling announcement, Fronk provided some more details, "One of our ideas at Courageous Lake is that we control a 52-kilometer greenstone belt and our existing resource and reserve sits on only two kilometers of that belt. There are gold showings up and down the entire belt, so what we are hoping to find are some new zones that can be put in on the front of a mine plan at Courageous Lake to improve the economics."

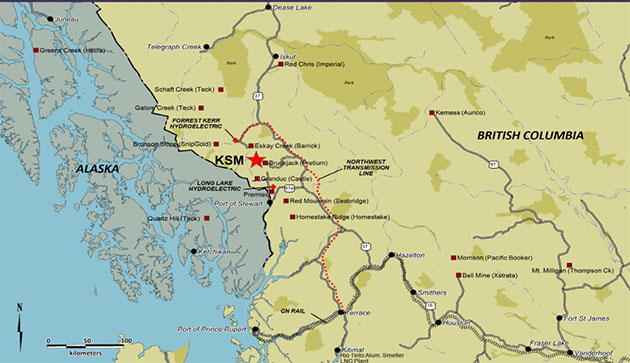

Earlier in February, Seabridge announced an updated resource estimate for the Iron Cap deposit at its 100%-owned KSM project in British Columbia. All existing drilling holes were included as was an additional 10,383 meters of diamond core drilling. This drilling was completed in 11 holes in 2017, and all of them returned wide zones of significant grade.

The figures for the updated estimate are:

Inferred gold resources increase 302% to 20.0 million ounces.

Inferred copper resources grow 379% to 8.6 billion pounds.

Inferred copper grade jumps 36%, Inferred gold grade rises 14%.

CEO Rudi Fronk explained, "The grades of these new zones are significantly higher than our reserve grades. So as these new zones are moved into reserves through infill drilling and engineering studies, we expect to see a dramatic improvement in the project's economics. Last year, before we even started working on Iron Cap, an updated mine plan incorporating the Deep Kerr zone showed the potential of reducing the total cost of gold production by over $300 an ounce. We believe Iron Cap could reduce production costs further due to its proximity to planned infrastructure and higher grades."

Canaccord Genuity analyst Tony Lesiak noted in a February 13 report on Seabridge that "the Iron Cap resource increased tonnage 133% with gold and copper grades higher by 1% and 27%, respectively. The resource was calculated utilizing three separate block cave shapes, exhibits strong continuity, employs a rigorous QA/QC program and, moreover, remains open for expansion down dip to the northwest with increasing grades."

Lesiak stated that "while the ~14.5Moz gold resource addition is impressive, KSM is already one of the world’s largest copper gold systems. The key remains finding additional higher-grade reserves for the front of the production queue."

"The discovery of vertically and laterally continuous zones of well above reserve grade material at Iron Cap, close to planned infrastructure, in our opinion, could be the catalyst that vaults KSM from a perceived option value in the minds of investors to strategic in the minds of potential partners," Lesiak added.

Canaccord has a CA$29.00 price target on Seabridge, which is currently trading at around CA$14.20.

Cantor Fitzgerald analyst Mike Kozak wrote in a February 13 update on Seabridge, "The 2017 exploration program at Iron Cap was a clear success. Gold, copper, silver and molybdenum grades all increased and contained metal at Iron Cap more than doubled."

He also noted, "We believe today's resource increase at Iron Cap will serve as the catalyst to bring large-tier JV partners to the table. We believe a partnership is potentially a H1/18 event."

Cantor Fitzgerald increased its target price on Seabridge to CA$25 from CA$24.

Seabridge CEO Rudi Fronk went into more detail about a potential joint venture, “We still think there's a chance of having a partner in place before this season begins, and if we don't that’s fine as well because there's another program we could do at Iron Cap to make it even better. The last hole we drilled at Iron Cap last year was the best, and there's a clear indication there's a lot better material down dip to what we had found already."

Read what other experts are saying about:

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Jake Richardson compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own shares of the following companies mentioned in this article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Seabridge Gold. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Disclosures from Canaccord Genuity, Seabridge Gold, Feb. 13, 2018

Analyst Certification: Each authoring analyst of Canaccord Genuity whose name appears on the front page of this research hereby certifies that (i) the recommendations and opinions expressed in this research accurately reflect the authoring analyst’s personal, independent and objective views about any and all of the designated investments or relevant issuers discussed herein that are within such authoring analyst’s coverage universe and (ii) no part of the authoring analyst’s compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed by the authoring analyst in the research.

Required Company-Specific Disclosures (as of date of this publication): Seabridge Gold currently is, or in the past 12 months was, a client of Canaccord Genuity or its affiliated companies. During this period, Canaccord Genuity or its affiliated companies provided investment banking services to Seabridge Gold.

In the past 12 months, Canaccord Genuity or its affiliated companies have received compensation for Investment Banking services from Seabridge Gold.

Canaccord Genuity or one or more of its affiliated companies intend to seek or expect to receive compensation for Investment Banking services from Seabridge Gold in the next three months.

Disclosures from Cantor Fitzgerald, Seabridge Gold Inc., Company Update, Feb. 13, 2018

Potential conflicts of interest: The author of this report is compensated based in part on the overall revenues of Cantor, a portion of which are generated by investment banking activities. Cantor may have had, or seek to have, an investment banking relationship with companies mentioned in this report. Cantor and/or its officers, directors and employees may from time to time acquire, hold or sell securities mentioned herein as principal or agent. Although Cantor makes every effort possible to avoid conflicts of interest, readers should assume that a conflict might exist, and therefore not rely solely on this report when evaluating whether or not to buy or sell the securities of subject companies.

Disclosures as of February 13, 2018

Cantor has provided investment banking services or received investment banking related compensation from Seabridge Gold Inc. within the past 12 months.

The analysts responsible for this research report do not have, either directly or indirectly, a long or short position in the shares or options of Seabridge Gold Inc.

The analyst responsible for this report has visited the material operations of Seabridge Gold Inc. (KSM and Iskut). No payment or reimbursement was received for the related travel costs.

Analyst certification: The research analyst whose name appears on this report hereby certifies that the opinions and recommendations expressed herein accurately reflect his personal views about the securities, issuers or industries discussed herein.