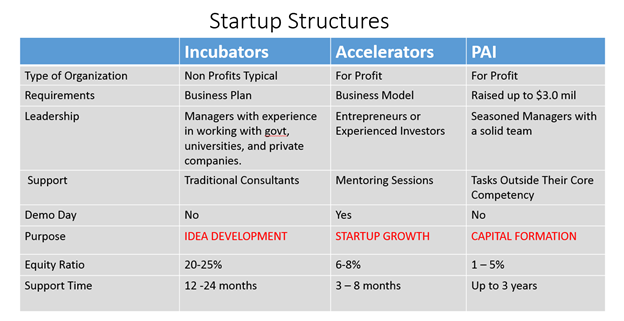

Accelerators have been around for years. Rising up as a product of the dotcom era, accelerators seem to be reinventing themselves as companies struggle to find capital in a regulated burdened OTC market. It is nearly impossible to raise money in the current OTC market space, especially when most of the money raised goes into SEC compliance instead of technology. Accelerators typically focus on different market segments like hardware development, biotech, space, nano-tech, and artificial intelligence. A typical accelerator would facilitate the seed capital needed to get an idea off the ground in exchange for equity. The accelerator would also provide mentoring and assistance to keep the project moving in the right direction. The concept is that an idea has to result in commercial viability in order to get additional funding from Venture Capital. This sounds a lot like what an angel investor does with one key difference and that is the project has a hard milestone culminating in a pitch for additional funding or the project dies. The next evolution of the accelerators is a Public Accelerator-Incubator (PAI).

Distinction between Incubator and Accelerator and PAI

Incubators are local in nature and want to attract large technology companies to come to their region to take advantage of the talent pool. Accelerators have a cookie cutter approach to investment and try to grow startups in a petri dish for a set amount of time and end with a demo day—culling the less productive group and then putting money into the most promising ones to keep progressing.

Accelerators can have huge market valuations as their projects start to take root. With the great risk there is also great reward. Google is well known for its Launch Pad project that seeks to cultivate the top talent developing software, network and application solutions for emerging markets. Another well-known company is Y Combinator, which invests $120,000 for 7% and also has a demo day. It has credit for accelerating some monster startups like Airbnb, Reddit, CoinBase and Dropbox. The company claims to have funded 1,588 startups having a combined valuation of over $80 billion. The biggest, or most visible, seems to be TechStars, located in Boulder, CO. Techstars has an international footprint in 150 countries. There are concentrations of accelerators, but small and large incubators are spread out throughout the country and many are located near college campuses.

Angel Investor Insight

The reason angel investors participate in funding small startups is the tremendous reward for being first to spot an idea. Angel investors know it's a numbers game and sprinkle their money amongst different deals. However, the long-term nature of the investment means it could be years until they have an opportunity to monetize their investment. Stephen Morsette wrote an informative article called "A Profile of Angel Investors," which compiled data from various sources that put numbers and perspective on the angel investor.

- 400,000 angels provide $50 billion in capital to over 50,000 companies each year

- Average age of angel investors is between 47 and 50 years old

- Typical Investment $50-75K

- Frequency is 18–24 months

- Five-year Time Horizon

- 80-90% of deals have multiple angels

- ROI 25-30% expected

Particular attention should be paid to the five-year time horizon and the frequency in which they do deals. Any disruptive or structural change to this model could have a huge multiplier effect on capital formation. The market saw an explosion of ICOs in 2017 and all angel investors could do is sit on the sidelines until their capital accumulated. A funding mechanism that could unlock capital quicker and deploy it faster is desperately needed. Market participants are going to need to pivot to keep up with the massive inflow of funds coming into ICOs.

In an economy moving at the speed of cryptocurrency, the biggest risk to angel investors today is opportunity risk. Digital Arts Media Network Inc. (DATI:OTC.MKTS), led by Ajene Watson, has come up with a hybrid model of an accelerator coined the Public Accelerator-Incubator (PAI). The PAI combines the process of careful vetting, and mentoring, with an equity sweetener that strikes a chord with each and every angel investor. Put yourself in the shoes of an angel investor and paint a scenario where an angel investor comes across the deal of a lifetime but is unable to participate to the level he wants because funds are currently tied up. Or, there is an innate fear of how long the investment will be tied up for.

In an October 2015 article by Forbes contributor Marianne Hudson, David Gitlin from Philadelphia-based law firm Greenberg Traurig LP talks about the need for "structured exits." The key bullet points in her article were quicker liquidity, less risk, flexibility of deal structure and equity kickers upon exit. The PAI structure from Digital Arts Media Network encompasses all these traits.

Opportunity cost tends to make angel investors very selective. This is where the PAI comes into play and allows the investor to diversify his holding yet keeps all the upside of his original Investment. In short, PAIs provide more liquidity to private investors faster, so that they can deploy more money to more companies more often.

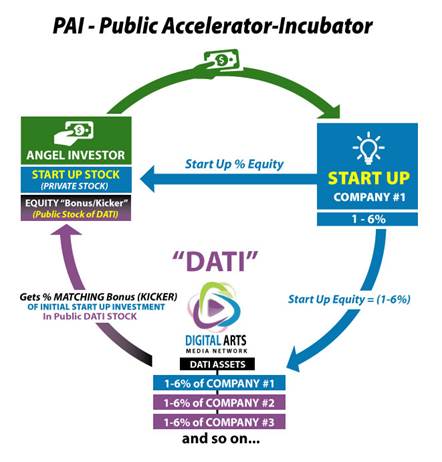

How a PAI Works

The most important facet in understanding the PAI concept is to realize that it doesn't compete with Accelerators or Incubators. A PAI complements what accelerators like TechStars are doing by offering an equity kicker to angel investors in the form of DATI equity. A startup company looking to raise money would give a small slice of its equity to DATI (normally 1–6%) in exchange for access to its Angels+ platform.

Angels would put an investment into the startup company as they normally would. In this case however, the angel investor receives a sweetener from the startup: equity in DATI. This equity, although separate and apart from the private investment in the startup, reflects a percentage of the private investment. This sweetener (DATI equity) can begin to be liquidated by the angel investor within 24 months.

DATI's primary assets are a portfolio of investments in high-growth tech startups with a $1–$5 million pre-money valuation. DATI is highly selective and tends to follow established smart money investors such as Jonathan Teo, Howard Marks and Robert Sigler. The angel investors get shares in the startup AND shares of DATI, which is a portfolio of other highly vetted startups that could be the next Snapchat or Dropbox.

Equity Kicker

When angel investors get an equity kicker in a public company that has no relation to the value of the underlying investment, they have access to part of their investment capital within 12 months without touching their original investment in the startup. Additionally, they don't feel any remorse if they have to sell the equity kicker because it doesn't affect their underlying investment. This equity kicker equates to an insurance policy on their investment that has the potential to grow unencumbered. An example of this type of equity kicker is analogous to a teenager getting car insurance on his own versus getting put on to their parents' policy. The teenager who got the car insurance on his or her own would likely need to work every waking hour just to keep the car insurance in place and would have little time for homework, which is akin to project development. The teenager on the parents' insurance policy would have to work a little to make the insurance payment but would still be able to devote a lot more time to his or her studies or in the case of the startup, the actual project development. It's easy to see in this example that the startup with the equity kicker is more likely to succeed because they aren't struggling for capital and if they did have a misstep or a set back the angel investor got a return on some of the money and might be more apt to put that back into the company if they were close to a milestone. The equity kicker is a win for the startup, a win for DATI, and a win for the angel investor.

DATI Portfolio

Vezt Inc. was the first company to leverage DATI's angel accelerator program. Vezt hopes to be the primary stock exchange of the music industry. Movie productions currently get funding through slate financings. Until now no mechanism existed for musicians to get financing. Vezt is rolling out initial song offerings (ISOs) so that musicians have a platform in which to sell their music to their fans. This platform will eliminate intermediaries. Before the Vezt ICO, DATI was engaged by Vezt for the Angels+ equity enhancement for its initial development raise [for music royalty rights platform and blockchain development] and earned 1.5% of the private startup in return. Through Angels+, investors received a 10% kicker in DATI stock. Currently, Vezt holds 35% of the token float, which represents 43.75 million tokens trading at $1.42/token. The market capitalization of Vezt is $21.74 million and DATI owns $1.5% or $326,000.

Fundanna is the first Regulation Crowdfunding platform for cannabis businesses. Founded by cannabis industry supporters, Fundanna was the first reg CF portal dedicated exclusively to the cannabis businesses in the United States. There are so many market segments in the cannabis space but a central overriding theme is that banks and lenders have limitations on funding "sin" based businesses. There is a void in the market and Fundanna's goal is to fill the void by giving investors access to early-stage cannabis investments and entrepreneurs. Guidelines allow startups to raise up to $1,070,000 each year through the Jobs Act. Fundanna's goal is to go to the crowdfunding portal when funding cannabis projects.

Openvision Labs Inc. OVL is a developer of live-streaming media communication products and services, which includes Openvision Networks and Real-Time Studio. With an estimated value of $5 million, OVL is currently running four major development programs:

- International streaming deals (African Network distribution demos)

- Live-streaming deals with event venues

- Exclusive content generation with actor Adam Beach

- Development of a new and improved live-streaming media player

As more consumers turn to internet-based streaming solutions for their viewing enjoyment, a unique niche opportunity presented itself to OVL. While other streaming companies focus on streaming recorded content, many consumers still have trouble finding live-streaming events and real-time news outlets without cable subscriptions. This is one gap that OpenVision plans to fill, along with reaching for those international markets that are underserved by existing providers.

Additionally, many streaming companies have seen tremendous success with exclusive content. OpenVision is working with actor Adam Beach to develop content exclusive to the OVL's online media streaming platform

Market Structure

DATI has 200 million shares authorized and currently has 21.5 million shares outstanding. This represents a lot of room for the company to grow the Angels plus platform and build out its portfolio of companies. There are currently 11.3 million shares in the float providing angel investors with enough liquidity for them to feel comfortable of the exit strategy should that need arise.

DATI Investment Thesis

The true value of DATI is in the valuation of the portfolio of companies that sign up for the Angels + platform. The startups that DATI is attracting have $1 million to $5 million pre-money valuations and have already raised considerable funds, which means they are ready to hit new milestones and raise more money in a higher round of financing, which would typically boost the value of DATI's underlying portfolio. These companies are on a parabolic growth trajectory and are attracting smart money. Adding more startups to the portfolio serves to enhance the equity kicker to the angel investors as they could see growth on their underlying investment and the equity kicker as the portfolio grows. Angel investors are long term oriented so the equity stock that they are awarded in DATI could be locked up for a considerable time until they see an investment worthy of new investment. Then they would sell DATI stock and probably demand another DATI equity kicker in the new venture perpetuating this ecosystem. As long as DATI maintains a liquid market for its securities and continually builds its portfolio of companies, there is no reason why this portfolio of startups couldn't outperform all the major indices.

Michael Sheikh is the founder of Falcon Strategic Research, which focuses on small-cap and micro-cap companies that are not covered by traditional analysts on Wall Street. Sheikh is an Air Force Academy graduate with a degree in economics; he was a KC-135 pilot. He was a stock broker for Dean Witter and was a research analyst for National Securities, covering the aerospace sector. He is a contract CFO for various public companies.

Want to read more Streetwise Reports articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Michael Sheikh: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. An affiliate company currently has a financial relationship with the following companies mentioned in this article: DATI. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts and images provided by the author.