NRG Metals Inc. (NGZ:TSX.V; NRGMF:OTCQB; OGPN:FSE) has two highly prospective, early-stage Lithium ("Li") brine projects (with near-term catalysts) in the heart of the Lithium Triangle. The Company has an Enterprise Value ("EV") [market cap + debt - cash] of C$28 M, (no debt, ~C$3 M in working capital). In early December the share price reached C$0.62, but has since declined 55% to C$0.28 (on morning of Feb. 13th).

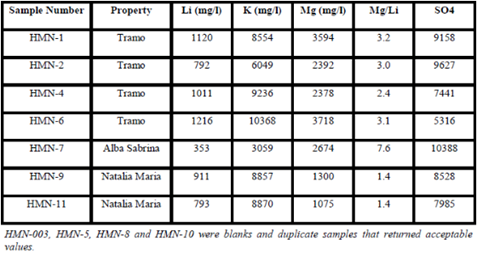

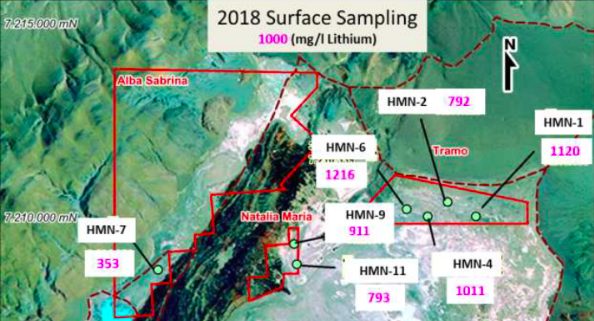

Late last month, NRG reported a fresh set of seven surface samples on its flagship Hombre Muerto North ("HMN") project. The samples were even better than the average of 20 samples collected in 2017, and comparable to samples released on Galaxy Resources' (ASX: GXY) / (OTCQB: GALXF) (then called Lithium One) nearby Sal de Vida project in 2010.

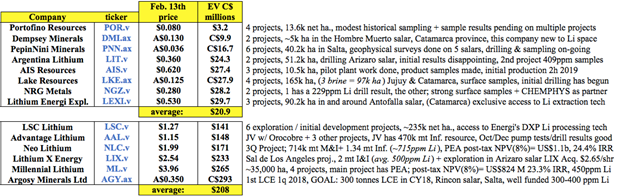

NRG Metals is 1 of 14 lithium brine juniors with all, or substantially all, of its properties or projects in Argentina. EVs range from C$3.2M to C$293M, with an average of ~C$101M. Roughly 40 projects are controlled by these 14 companies, but closer to 20 projects have meaningful work being done, or planned, in 1h 2018. NRG controls two of these active brine exploration programs.

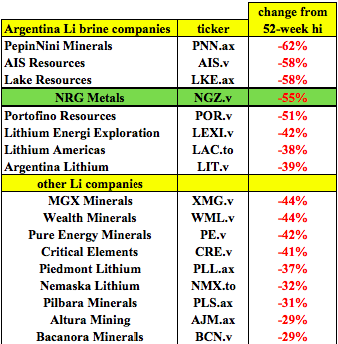

Sell-off in lithium sector could be a buying opportunity

As can be seen in the chart below, the lithium sector is in the middle of a moderate sell-off. Many closely followed names are down ~30%–60% from 52-week highs. A primary reason is news out of Chile regarding settlement of a dispute between giant producer SQM (NYSE: SQM), and a state-controlled entity known as Corfo.

The two parties agreed to extend through 2030, and increase SQM's production quota in Chile, to as much as 216k tonnes LCE/yr, (compared to ~60k tonnes/yr capacity currently). This triggered a sell first, ask questions later response. However, experts I trust think SQM may never come close to 216k tonnes/yr out of Chile's Atacama salar because a new royalty schedule (sliding scale, up to 40% on lithium prices above US$10k/tonne) incentivizes SQM to advance two world-class projects it controls outside of Chile. Bottom line, there won't be a flood of new supply from SQM anytime soon!

Is positive news from NRG Metals being ignored?

On November 16, management announced that it had completed a strategic alliance with a prominent private Australian-Chinese enterprise named Chemphys, specializing in the manufacture of high-purity lithium products. The primary objective was to advance the exploration of NRG's HMN project straddling Salta and Catamarca Provinces, and, if warranted, move into development.

Chemphys wants to help NRG fast-track HMN to modest commercial-scale production as soon as the second half of next year. Yes, an aggressive timeline, but that's the stated goal.

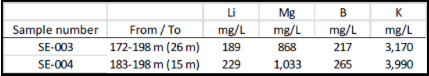

On December 7, management announced a Li brine discovery from a drill hole that reached 307 meters in depth at its 100% controlled Salar Escondido project in Catamarca. Li mineralization was confirmed over 135m to the bottom of the hole. Difficult drilling conditions prevented the collection of samples below one taken from 183 to 198 meters that recovered 229 mg/L Li and 1,033 mg/L Magnesium ("Mg").

The drill bit ended in brine at the 307m mark, so mineralization remains open at depth. Management believes it's reasonable to expect (but no assurances) higher Li concentrations below 198 m. President, CEO & Director Adrian Hobkirk commented,

"It would be surprising if the very first drill hole into Escondido happened to have hit the best mineralization."

Other factors beside grade will determine if the project might be economically viable. For example, permeability largely impacts flow rates. Referring to the press release,

"In addition to discovering lithium in our first hole, another positive characteristic of the basin is the potential for high permeability. The material that hosts the brine zone is comprised mainly of loosely consolidated sand and conglomerates, which should be highly permeable and allow high pumping and recharge rates."

As mentioned earlier, on January 26th, exciting new surface samples at HMN were released. Three samples returned values >1,000 mg/L Li, as high as 1,216 mg/L Li, with the top four averaging 1,065 mg/L Li. The average Mg/Li ratio was 3.2 to 1, or 2.4 to 1 excluding the sample from Alba Sabrina.

Jose de Castro, COO of NRG, commented,

"We are delighted by the high lithium values and the favorable low Mg/Li ratios at HMN. NRG recently obtained permits from the provincial government of Salta for drilling and construction of evaporation test ponds, and the Company expects to award a drilling contract and commence construction of test ponds shortly."

Both an initial drill program on HMN, and several additional drill holes at Escondido, will begin this quarter. In addition to ~C$3 M in working capital, management just announced the acceleration of 15,810,000 warrants, which will generate up to an additional C$3.16 M.

NRG Metals' Hombre Muerto North ("HMN") project

The HMN project is on the northern end of the prolific Hombre Muerto Salar, 170 km southeast of the city of Salta, adjacent to FMC Corp's producing Fenix lithium brine operations and Galaxy Resources' Sal de Vida development-stage project. Fenix is the largest producing lithium facility in Argentina, and the Sal de Vida project has a Bank Feasibility on it that boasts a post-tax NPV(8%) of US$ 1.4 billion. NRG's technical team is strong, please see the following bios.

In looking at brine samples from peer Li juniors in Argentina, the vast majority don't approach or surpass 1,000 mg/L Li. NRG has reported some of the best recent surface samples anywhere in the country, but management needs to follow up with drilling and pump tests. NRG's stock remains highly speculative, but it's lower risk than it was when the share price hit C$0.62.

While Alba Sabrina is the largest concession in the HMN project, it has shown the lowest Li values and highest Mg/Li ratios. The Tramo concession, plus the Salar Group (combined salar properties of Natalie Maria, Gaston Enrique, Norma Edit and Viamonte), encompass 1,148 hectares, about 11.5 sq. km—plenty of ground to develop a project.

Readers should not write Alba Sabrina off; management believes there's a reasonable chance that Li and Mg values improve with depth.

Please see NRG's October 2017 43-101 Technical Report on HMN.

NRG Metals' Salar Escondido project

Escondido comprises mining concessions totaling ~29,180 hectares (72,100 acres) ~280 km southeast of the provincial capital of Catamarca. After the salar was formed, it was buried by coalescing alluvial fans, hence the name "Salar Escondido," which translates to "hidden salar" in Spanish.

Escondido's large footprint, >29,000 hectares (believed to cover a large portion of the basin) allows for significant further exploration. The project can be found on the map above (from Portofino Resources' fact sheet) directly beneath CATAMARCA. Utilizing more effective drilling techniques to facilitate the sampling of brine targets, especially at depths below 200m, will help in the preparation of a maiden mineral resource estimate.

Conclusion

NRG Metals continues to report good news, but its stock price is down 55% from early December's all-time high. Readers should take note that there have been plenty of mishaps and misses among lithium brine juniors exploring in Argentina. Liberty One, Southern Lithium, Lake Resources, PepinNini Lithium and Ultra Lithium have experienced significant problems over the past year, and are down an average of 70%.

Except for a few sector-wide delays in Argentina, (especially from mid-December to mid-January), NRG is prudently advancing both projects. The company is well funded, and ongoing warrant exercise continues to bolster the balance sheet. Near-term catalysts include drilling, pump tests and the construction of pilot evaporation ponds. NRG's strategic partner, Chemphys, is excited by ongoing sample results at HMN and is anxious to get drilling. Chemphys has deep pockets, a tremendous amount of Li market experience and strong industry contacts.

The Escondido project will be the subject of several drill holes in coming months. The first hole, announced December 7, proved that NRG's technical team knows what it is doing. If Li values improve with depth, Mg levels remain relatively low, pump tests point to favorable permeability characteristics, and the attractive width of the observed mineralization is consistent across multiple drill holes—then Escondido could be a very valuable asset.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis, and he is a Chartered Financial Analyst (CFA). He holds an MBA degree in financial analysis from New York University's Stern School of Business.

Peter Epstein Disclosures: The content of this article is for informational purposes only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research, [ER] including, but not limited to, commentary, opinions, views, assumptions, reported facts, estimates, calculations, etc. is to be considered implicit or explicit, investment advice. Further, nothing contained herein is a recommendation or solicitation to buy or sell any security. Mr. Epstein and [ER] are not responsible for investment actions taken by the reader. Mr. Epstein and [ER] have never been, and are not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and they do not perform market making activities. Mr. Epstein and [ER] are not directly employed by any company, group, organization, party or person. Shares of NRG Metals are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Peter Epstein owned shares and/or stock options in NRG Metals and the Company was an advertiser on [ER]. By virtue of ownership of the Company's shares and it being an advertiser on [ER], Peter Epstein is biased in his views on the Company. Readers understand and agree that they must conduct their own research, above and beyond reading this article. While the author believes he's diligent in screening out companies that are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. Mr. Epstein & [ER] are not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article. Mr. Epstein & [ER] are not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. Mr. Epstein and [ER] are not experts in any company, industry sector or investment topic.

Want to read more Energy Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts and graphics provided by author