You've got to feel sorry for poor old Mom & Pop—after about eight or nine years of sitting on the sidelines, they finally get conned into venturing into the stock market at last, only to get promptly lynched. Somebody's got to get left holding the bag, right?

On 29th January it was written in BROAD US STOCKMARKET MELTUP update, "The higher is gets the more dangerous it becomes, and now we have news that this melt up in the broad market is being driven by the retail investor, just as we would expect going into the top. SentimentTrader reports that so far this month, 34% of the trades have been accounted for by E-Trade and TD Ameritrade, more than triple the low in 2016, with daily average revenue trades skyrocketing."

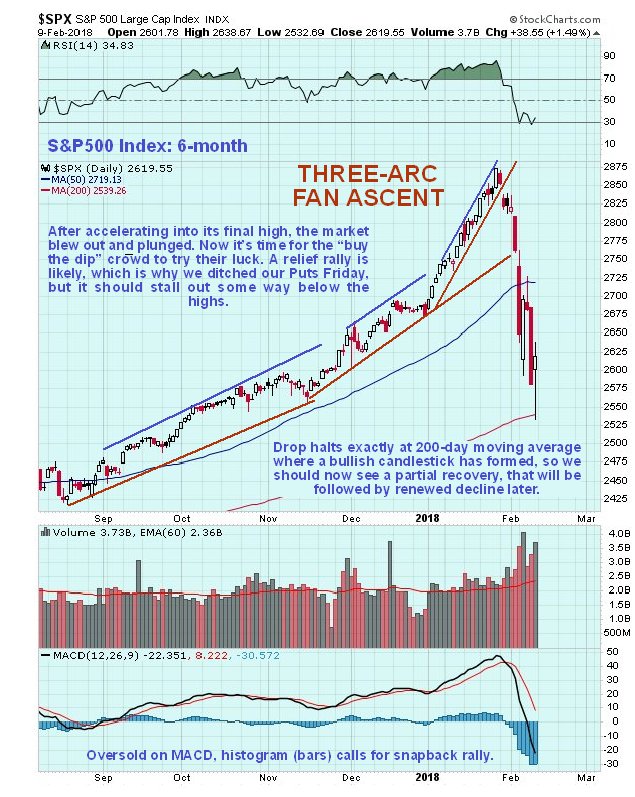

Looking at the latest 6-month chart for the S&P500 index, we can see that it reversed on Friday, at its rising 200-day moving average, leaving behind a bullish high volume candlestick on its chart that approximates to a hammer. Thus it now looks like we will see a more significant bounce before the market drops to the first downside target shown on the 2-year 3-month chart in the CRASH TARGETS update posted early on Friday. We saw this happening and ditched all our Puts for a good profit, especially our oil Puts, which we sold right at the bottom.

What should we now expect? Given that the market was the most overbought in history following what amounted to a parabolic ramp into a blowoff top, and that it was largely driven by speculative fantasy, a brutal bear market is to be expected that will erase 30%–50% of its value. However, a market never normally goes into complete collapse from way above a 200-day moving average; usually a drop like this into a rising 200-day moving average is followed by a significant relief rally that allows this average to climb even higher and then roll over—this permits the rotation of more stock from stronger to weaker hands. Thus we should be aware that the market could retrace perhaps 50% of the plunge, which would take it back to the 2725 area, although when the time comes we will be flexible in deciding when it's done. After that it should roll over and drop hard again. So our battle plan is to wait on that and then short it again if the time looks right (or buy inverse ETFs).

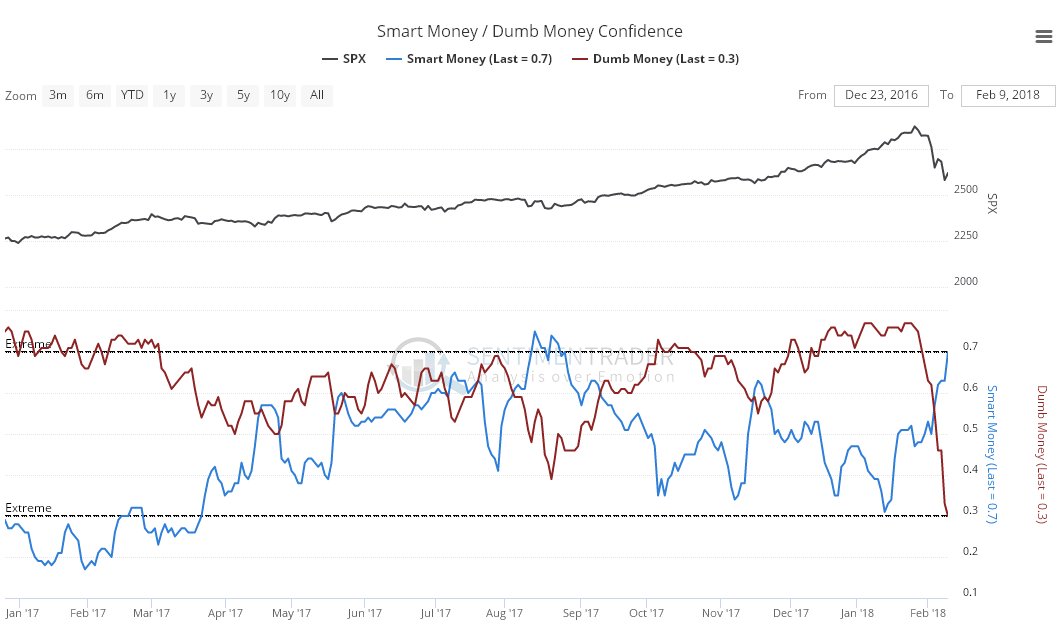

The latest chart showing Smart and Dumb Money confidence is actually funny, as it shows the little guy "foaming at the mouth" bullish going into the top, and then legging it for the hills late last week, when, it is most interesting to observe, Smart Money quickly became bullish. This provides important evidence that our assertion that the broad market is set for a significant bounce is indeed correct, and we may even need to raise our target for this move. Gold and silver stocks will advance at the same time.

Click on chart to pop-up a larger, clearer version.

Chart courtesy of sentimentrader.com

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

Charts provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stockmarket analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.