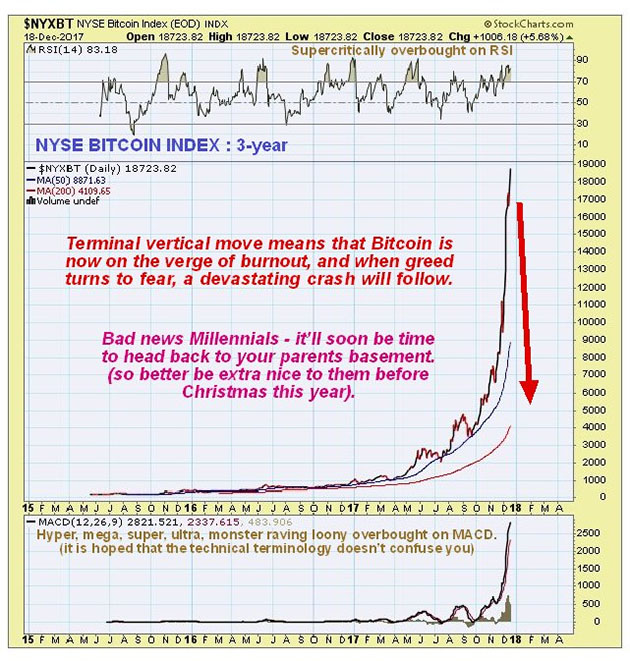

As most readers know, Bitcoin is now a monstrous bubble that has the dubious distinction of exceeding in magnitude all previous bubbles in history, going right back to the Tulipomania in the 17th Century. Its recent ascent has been steeper than the north face of the Eiger and even the vertical face of Half Dome in Yosemite. As anyone with even basic knowledge of speculation knows, this means its days are numbered, and it won't be long before a brutal crash occurs that wipes out latecomers and even dramatically slashes the profits of earlier arrivals on the scene. The only propellant this market has now is the "Greater Fool Theory," which is where you buy simply because you believe an even bigger idiot will turn up later to buy it off you at a higher price—needless to say, this works until it doesn't.

The start of futures trading on the CBOE today is seen as a dangerous fundamental magnet that has pulled the price vertically higher over the past few weeks, sucking in naïve traders in droves, like the siren song drawing sailors to their doom. Bitcoin's rise to the dangerous round number $20,000 level over the weekend is seen as the "Greatest Fool" arriving on the scene amid great fanfare and pageantry. Let the slaughter begin!

Let's not be churlish about this, however, it is important to give credit where it is due. Those who got in early on this Bitcoin mania are true geniuses who have every reason to feel proud of themselves, having made themselves a fortune from even relatively modest stakes. The problem for many such investors, though, is that they don't know when to call it a day and jump ship; many overstay their welcome and end up losing most of their gains. If you, dear reader, are one of these fortunate individuals you should get the hell out with the minimum of delay and consider yourself lucky. Sure you might miss some more gains short term, but when this thing goes down it will be a lot faster than the Hindenburg and leave behind a massive impact crater, as unbridled greed changes in a flash into visceral fear and blind panic and all the recent lemmings disappear straight over the cliff edge—it will go into freefall and bids will evaporate.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Want to read more Streetwise Reports articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

Chart provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stockmarket analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.