Dean claystone project; Clayton Valley, Nevada

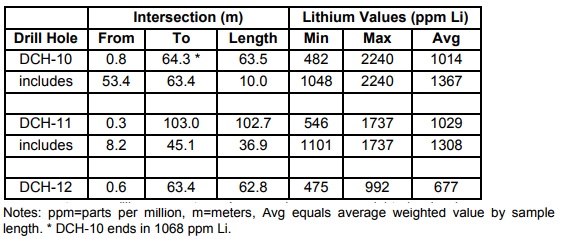

Things seem to go as planned for Cypress Development Corp. (CYP:TSX.V), as the first three holes drilled on the Dean project returned very solid intercepts as part of the Stage 2 fall program. Results ranged from 102.7m @1029ppm lithium for hole DCH-11 to 62.8m @677ppm Li for DCH-12. This last hole generated dark green to black ash-rich mudstone at a depth of 53.4m. Management hasn't seen this before, and assumes that this type of claystone doesn't differ a lot recovery-wise, and just has a different color, but has to sample and test this first, of course, to be sure. This is a table of the last results:

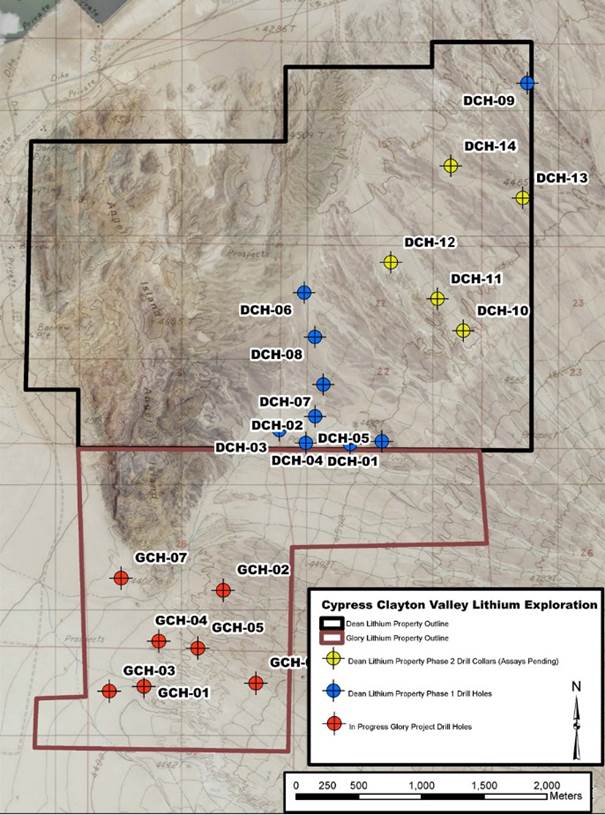

These results are in line with the results of the earlier completed holes, and confirm the continuity of the mineralization at the Dean Project. It is still early days, but it seems that a mineralized zone of about 4km x 2km has already been outlined here, as stated by management in the news release. Because of this size, Cypress seems to be firmly on track to prove up a large bulk tonnage deposit in my view, as I guesstimated in my first article on the company, which was also based on a 4km x 2km target zone. Below is a map of the drill collar locations:

Clayton Valley, Nevada; drill hole locations

As can be seen, there is still a lot of the Dean property to be explored. The holes that got lost at depth were lost because of wet clay, and will demand different equipment. The company is looking into this, and might return to these holes during the next drill program, possibly with larger diameter core. The average target depth is at least 300 feet or about 100m. Most holes are ending in claystone and mineralization so far, but there is no real need to go much deeper. The fall 2017 program was planned for 12 to 14 drill holes, up to 1500 meters of core, and is divided between Dean and Glory. Results from the remaining holes on Dean are expected in December, and in the meantime the drill rig was already moved south onto the adjoining Glory property where drilling is continuing and seven holes are planned.

The company is already making preparations to continue infill drilling on Dean and Glory during the first quarter (aiming at mid-February), and will apply for a drill permit to the BLM in January 2018.

Laboratory work continues to test the solubility of the lithium-enriched claystone under varying conditions and reagents.

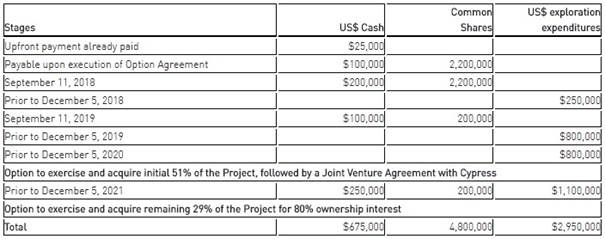

Besides the drilling news, and faster than I had anticipated, Cypress managed to cut a deal with another interested party for the majority of its Gunman Zinc/Silver Project in Nevada. This party was Pasinex, which acquired the option held by Silcom, which entitled it to buy 80% of Gunman. Pasinex is considered a stronger partner by Cypress management as it is a zinc producer. Here are the terms of this option agreement:

The treasury of Cypress contains about C$1.5 million at the moment, which will take the company well into 2018. Drilling in Nevada claystone is cheap, the target depth just 100m and goes fast, so the drill programs go a long way with the current cash position. For example, 10 holes can be done of 100m each at say $200/m all-in costs, which results in total costs of just C$200,000. Management estimates the costs for the current drilling and met work coming in less than C$300,000.

Cypress Development is proceeding with building the resource at Dean according to plan, and there is no doubt in my mind the company will prove up a significant deposit, hopefully to the tune of 6-7Mt LCE. More drill results will be coming in during the next few weeks before year-end, also for Glory, and I estimate another batch of 900–1000ppm Li average grade assays. Awaiting the round of drilling, a bit more focus will shift toward important met test work in order to advance earlier and successful testing toward obtaining a fully commercial recovery method for lithium. If management succeeds in this department as well, Cypress could easily be a multi-bagger as the project is relatively large.

Glory claystone project; Clayton Valley, Nevada

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at http://www.criticalinvestor.eu/, in order to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

Disclaimer:

The author is not a registered investment advisor, and has a long position in this stock. Cypress Development is a sponsoring company. All facts are to be checked by the reader. For more information go to Cypress Development Corp. and read the company's profile and official documents on Sedar, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Want to read more Energy Report interviews and articles? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.