As I sat in my den last evening looking out over lovely Lake Scugog and her plethora of weeds clogging shorelines, intake lines and Yamaha outboards, I was contemplating the likelihood of a rally into year-end and whether or not it might include ANYTHING that I own because, quite frankly, nothing in my world has worked very effectively since the first half of 2017. With the exception of the Pilbara play in West Australia, the junior gold and silver exploration issues have been sadly underperforming the lithium and base metals explorers largely because of the sharp advance in non-precious-metal prices, which in turn was triggered more so by U.S. dollar weakness as opposed to an uptick in industrial demand. There have been virtually no new gold or silver discoveries in either of the Americas and developmental stories cannot hold a dime store candle to the blockchain and marijuana stocks. Accordingly, it has been difficult to ascertain the correct positioning with a scant five weeks left in 2017.

However, after looking down the list of office parties to which I have been invited next month, it reminded me of 2015 when the Commercials covered into year-end and actually took their aggregate short position down to 2,911 contracts, down from the record high seen in July of that year. In doing so, they cashed a gargantuan paycheque with seven-figure bonuses across the board and since we have not seen wins of nearly that magnitude here in 2017, they still have roughly $70 per ounce of profit on that aggregate net short.

Since the $1,360 peak back in September, the price has retrenched to below $1,300 to as low as $1,262 but you have to trust human greed and the need to crystallize 2017 performance numbers and therefore assume that there will be a mad dash to cover before the shut-down which is probably only three weeks away. The major question for me is whether there will be a catalyst creating an air pocket in price between now and year-end. Tom McClellan points to a 13 1/2 month cycle low due for gold at the end of December but cycles are all about timing and rarely about price so therein lies the rub. I am going to argue that downside risk is contained by way of the size of the Commercials' short position with the only possible surprises being an upward jolt into the New Year.

As an exercise in masochistic experimentation, I recently added some limited dollar exposure call options on the JNUG (leveraged Junior Gold Miner ETF) and the NUGT (leveraged Senior Miner ETF) by way of the JNUG January $15 calls (at $2.00) and the NUGT January $30 calls (at $2.65) earlier in the week and will add to both positions this week. I am also taking an equal dollar position in December silver futures at $17.00 with an iron-clad stop loss at $16.50; I am willing to grant gold's evil red-haired, freckle-faced twin a $2,500 per contract face-rub but no more.

With the junior explorco's having gone completely to sleep (unless you are looking for lithium or nugget gold in West Australia), self-medication has become the order of the day. I keep banging my head on the desk trying to ascertain exactly how it is that Seabridge Gold Inc. (SEA:TSX; SA:NYSE.MKT) can pay $20 million for 5,200 acres in Elko County on trend to the Klondex Mines Ltd. (KDX:TSX; KLDX:NYSE.MKT) Midas Mine with Stakeholder Gold Corp.'s (SRC:TSX.V) 3,800 acres (closer to the Midas) being valued at a mere $5.6 million and located immediately SE of Seabridge. It seems that traders are so completely distracted by this ten-year bubble in blue-chip stocks and blockchain speculations that they have determined that gold and silver discovery stories are a mug's game thoroughly dominated by "special situations" mentalities. For this sexagenarian scribe, there will be a dynamic return of investor interest and capital to the precious metals sector and the accumulation of strategic explorers with solid teams will result in big gains next year.

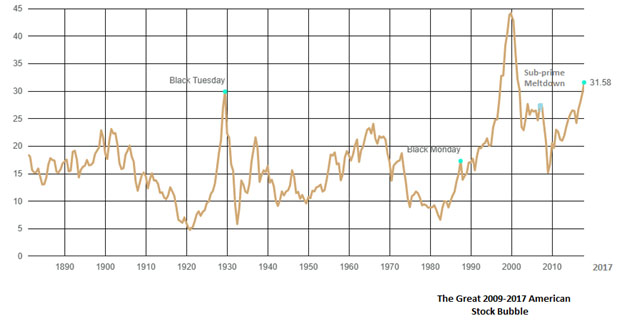

These well-situated juniors like Stakeholder remind me of the attractive young lass at the high-school dance who is lined up on the back wall next to Grace Kelly, Angelina Jolie, Brigit Bardot, Charlize Theron, Marilyn Monroe and Sophia Loren. There is nothing at all wrong with the lady but the competition is simply too fierce. What drives prices for everything is demand and as we approach the terminus of 2017, central bank interventions have trained the chimpanzees manning the desks of all the major trading houses to buy any all dips in all markets where the ECB, BoJ, or SNB have a bid—and that means demand for stocks. Ten years ago, the world was entering the final stages of the 2001–2008 bull market with many similarities now popping up but what is undeniable is that stocks are more richly-priced today than back then as seen in the chart below. Just as in 1980 and 2000 and 2007, the choruses of "But it's different this time" ring out like sleigh bells on Christmas Eve but the reality is that all markets inhale and all markets exhale and the only thing preventing the latter has been intervention. And as is the case with all air-breathing creatures, if they are not allowed to eventually exhale, they die never to inhale ever again.

The upshot of today's commentary is this: Gold emerged from a five-year bear market after bottoming at $1,045 and has been a series of higher highs and higher lows since then. The shares of gold miners, developers, and explorers have underperformed the metal throughout the bulk of 2017 and are due for a reversal. Accordingly, I am preparing to head out to the local LCBO to stock up on seasonal libations in the event, of course, that we get company. I am also stopping off at the local apothecary so that my medical professional can dispense "materia medica" in the event that gold fails to advance as per my forecast and I find myself in need of tranquilization.

It's a tough business.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Michael J. Ballanger: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Stakeholder Gold Corporation. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies referred to in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Seabridge Gold and Klondex Mines. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Stakeholder Gold, a company mentioned in this article.

All charts courtesy of Michael Ballanger.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.