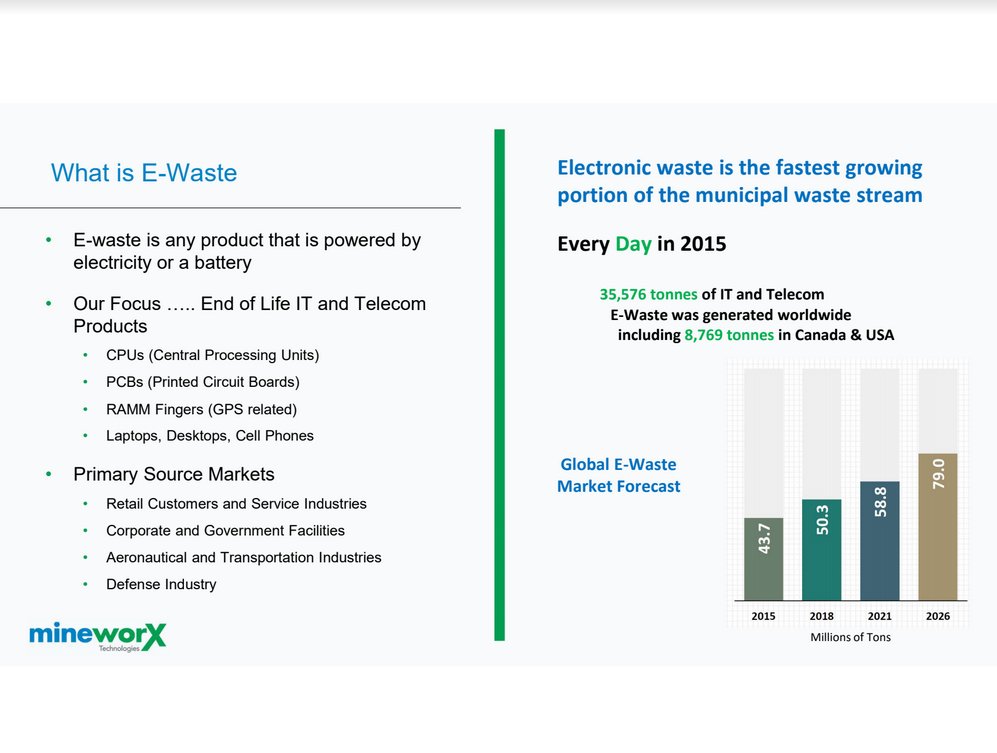

This is a big, big story that is only just starting to leak out—very, very few investors know about it. Mineworx Technologies Ltd. (MWX:TSX.V; MWXRF:OTCQB) has developed a pollution-free process for extracting gold and base metals from E-waste (electronic waste), which promises to free up and make available a vast quantity of these metals. This is because the amount of this E-waste produced globally is enormous. As the following picture, lifted from a recent Mineworx presentation, makes clear, 35,576 tonnes on average of this waste was generated per day in 2015, which includes 8,769 tonnes in Canada and the US alone. So there is no shortage of material to work with.

Click on picture to pop up a larger, clearer version.

The following page from the presentation makes clear that this E-waste is extremely rich in gold. Just one ton of E-waste will yield approximately 1000 grams of gold, with a value, subject to the gold price, of $38,530. Compare this with what you get chugging through a ton of mining ore, which yields a paltry 10 grams, with a value of only $400, and you will start to get an idea of how big a business this is going to be, and when you throw in the fact that it is an eco-friendly non-polluting way of processing this waste, it should be obvious that this is going to be a massively lucrative business for the pioneers of this process, which may fairly be described as "urban mining."

Click on picture to pop up a larger, clearer version.

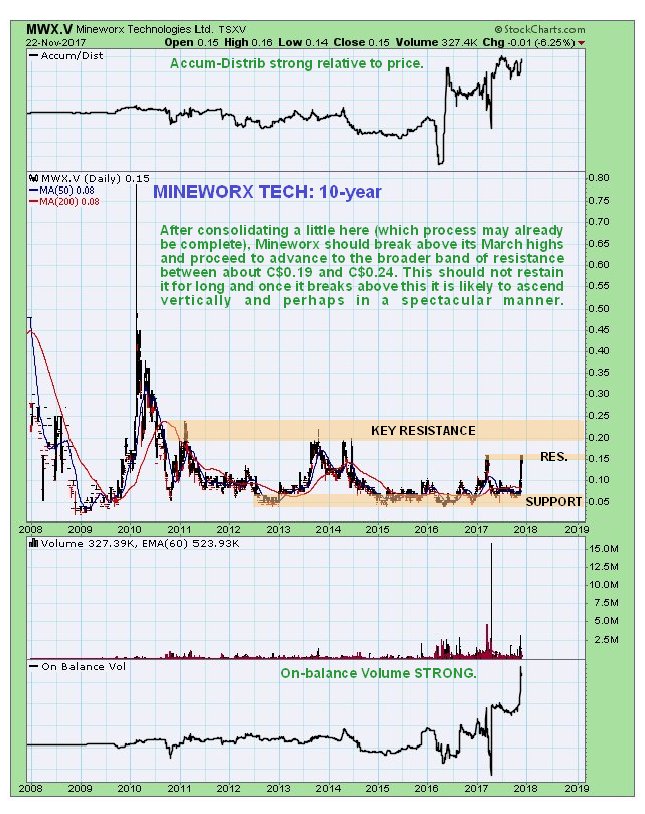

Although few know about this yet, it is obvious from the latest Mineworx charts that somebody does, because the price of the stock has doubled over the past of couple of weeks, with the price running up almost vertically on strong volume to arrive at a resistance level whose origins become clear on longer-term charts. This spike has caused it to become extremely overbought so it has paused in recent days to consolidate its gains, as we can see on its latest 6-month chart below. However, given the magnitude of this story, which is still not widely known, it is considered unlikely that it will react back – more probable is that it will consolidate for a week or two at most before taking off higher again. A point worth making here is that while the volume on the rally so far is good, it is not all that big, given the magnitude of the story, which is because it is still not widely known.

While the 6-month chart might seem a little unnerving for would be

buyers of a more timid disposition, the longer-term 10-year chart

reveals that there is big upside potential once Mineworx succeeds in

breaking above the resistance level at the March peak, which is what

caused it to stop here, and then above that, resistance at the higher

peaks between about C$0.19 and C$0.23. Once it gets through these

levels, which could happen fast given the magnitude of this story, it

should fly.

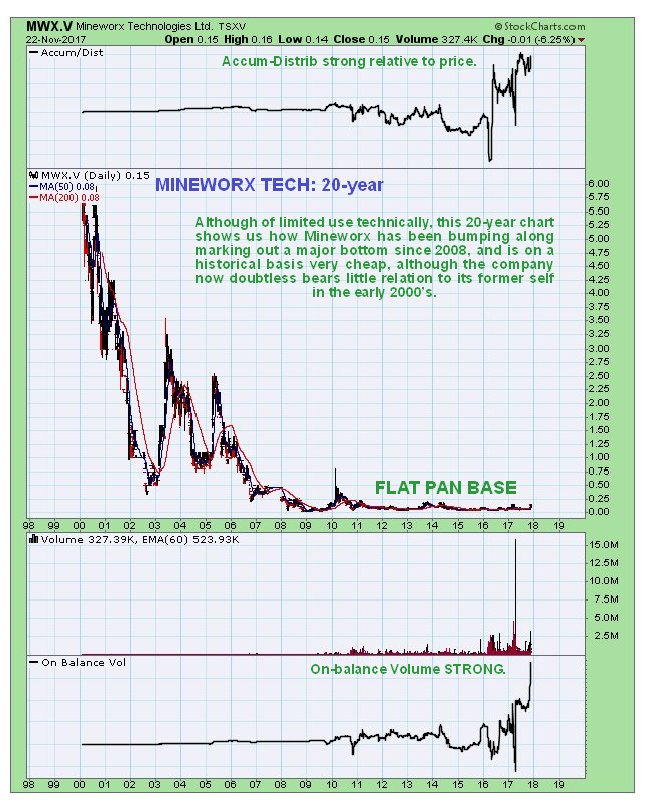

The 20-year chart certainly makes the stock appear historically cheap now, with the rally of the past few weeks scarcely registering as a blip on this chart, although we should bear in mind that we are not comparing like with like here, as the company has doubtless changed completely since its highs in the early 2000s.

Although it looks like we missed the start of this bull market, that is not entirely true, because we bought Enviroleach Technologies Inc. (ETI:CSE) before it broke out and rose steeply. Whereas Mineworx has developed this extraction process and has, it is believed, propriety rights over it, Enviroleach has an agreement with Mineworx and actually uses the process, and you will see it mentioned in the Mineworx presentation. Whilst we have done well with Enviroleach, which is currently reacting back on much lighter volume and looking set to turn higher again soon, Mineworx stock has much higher leverage because it is a much lower priced stock, and of the two is therefore considered to be the most attractive, although Enviroleach itself should continue to prove to be a most worthwhile investment.

In conclusion, Mineworx is considered to be an extraordinarily attractive investment here, because the story behind it is huge, as the company is in the vanguard of the movement to process gold and base metals in vast quantities from electronic waste in an environmentally friendly manner. We are well aware that the stock is technically overbought here, and could react back a little short-term, in which case it would simply be more attractive, but the danger here is missing it by waiting to clip a few cents off the price, since this stock is likely to storm ahead again before long. So it is considered best for those interested to go ahead and buy it here, and Canadian investors can go ahead and buy it here today while U.S. investors are more concerned with eating turkeys, etc. Mineworx trades in good volumes on the U.S. OTC market, and although there is a heavy 276.7 million shares in issue, this is probably commensurate with the scale of the company's operations and factored into the price anyway.

Mineworx Technologies website.

Mineworx Technologies Ltd, MWX.V, MWXRF on OTC, closed at C$0.15, $0.123 on 22nd November 2017.

Presentation pictures courtesy of Mineworx Technologies Ltd.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Disclosure:

1) Clive Maund: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. CliveMaund.com disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Mineworx and Enviroleach, companies mentioned in this article.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stockmarket analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.