In the last Oil Market update posted on Oct. 23, we observed oil's intrinsic strength, and how it looked like it was building up to break out of its giant, complex, Head-and-Shoulders (H & S) bottom. We were wary of its reacting back short-term on dollar strength, but that has not happened. Instead, it has continued to firm up.

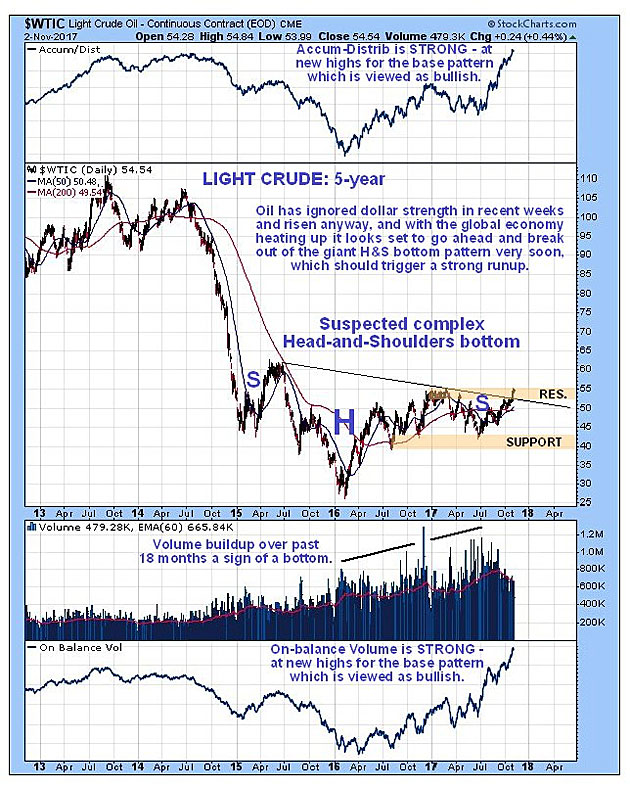

Oil has already broken above the neckline of its H & S bottom and is at the point of breaking above key resistance at $55 at this year’s highs. This will mark a clear breakout from the H & S bottom and should trigger a strong run-up. We can see all this on the latest five-year chart for Light Crude, shown below, and again on the strength of its volume indicators, which suggest that a powerful rally is on the cards for oil, and probably soon.

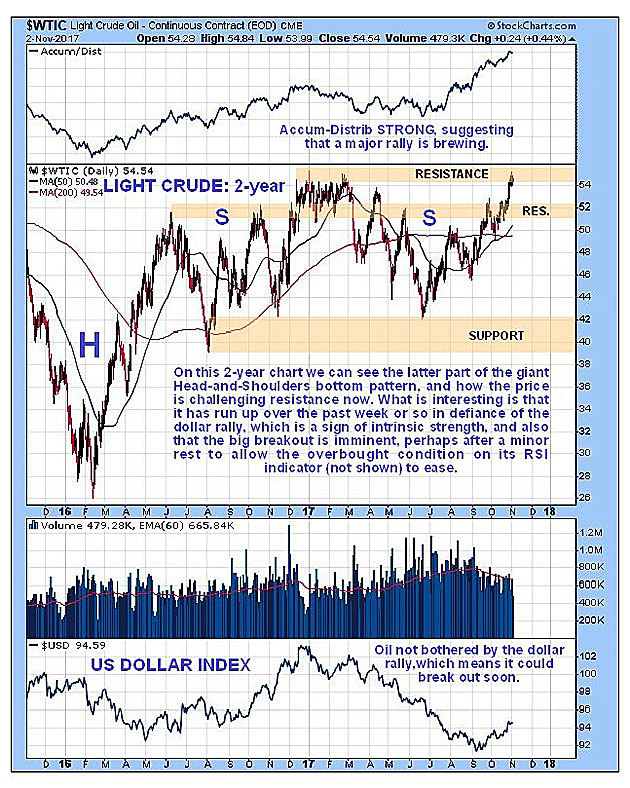

We can see recent action in context and in more detail on the 2-year chart, which has the U.S. Dollar index at the bottom for comparison. It shows that oil has not (thus far, at least) been bothered by the strength in the dollar, and has advanced to arrive at the key resistance approaching and at the $55 level. Given this intrinsic strength, it now looks likely that oil will push ahead in coming weeks and break out above this level, regardless of whether the dollar index pushes on to its target in the 97 area. Such a breakout can be expected to trigger a robust advance. However, given that it is now getting very overbought on its RSI indicator (not shown) it is in order for oil to take a brief pause to consolidate before the breakout. . .although such a pause may not happen.

Overall then, this is a very positive picture indeed for oil, which looks set to advance strongly in coming weeks/months. A provisional target for the advance is the $80 area.

Before closing, it is worth commenting briefly on an important geopolitical development that will likely have a bearing on the oil price. The despotic Saudi regime, which has been a longtime ally of the U.S., is apparently upset at charges being pressed against it in relation to the September 11, 2001, attacks, and is now looking more to the east. Specifically, it is showing great interest in the forthcoming Chinese yuan-denominated oil futures contract. If it presses ahead with this, the Saudi regime could find itself suddenly being reclassified as a foe, and find the U.S. military on its doorstep. If the Saudis do go ahead and get involved in the yuan oil contract, which will undermine the dollar, it will be interesting to see what the U.S. response is.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Want to read more Energy Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

Charts provided by the author.