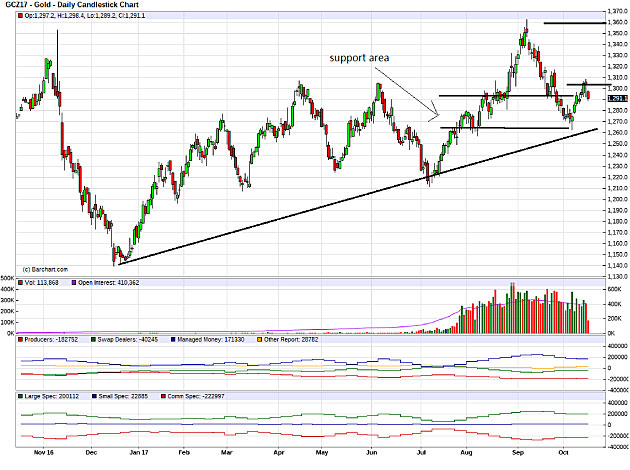

The gold market is acting as expected and is finding support in the $1,265 to $1,295 support zone. In fact, on Oct. 8 it bottomed and started the rally you see in the chart to almost $1,310. We are still at critical levels on the chart, with the year-end weakness season approaching. For the bullish view we want to see a break above $1,310, which probably would signal a move to test next resistance at $1,360.

On the bearish side, a drop below support and below the last low around $1,270 would probably also show a drop below the trend line, and we would start going lower for typical year-end weakness. There is no real conclusion on the COT position. Some managed money has sold and some commercials covered shorts.

Could this year-end be different? I do see a couple of flies in the ointment that say "maybe so."

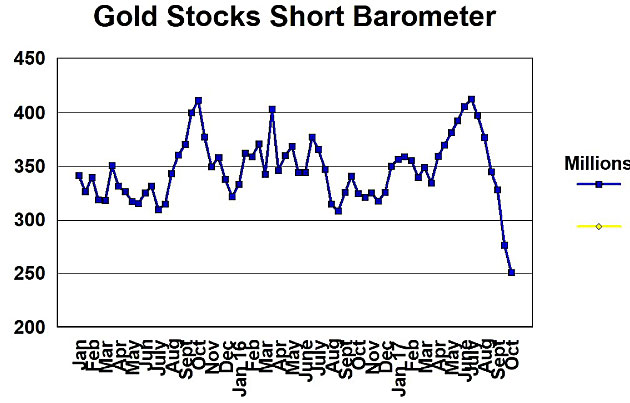

The strangest thing I have seen in many years is the massive and unprecedented short covering in the gold stocks. Here is my last short barometer and you can see the drop to new lows, probably not seen in the past decade. The steep and steady decline is another strange event.

Assuming this is a lot of smart money, they are saying they see a rally coming in gold stocks, despite the fact that we would normally see year-end weakness.

I previously commented that the 93 area would be strong resistance on the U.S. Dollar Index. If it cannot make a solid break with a close well above 94, it will be difficult for the U.S. dollar gold price to weaken.

I will be watching the above charts closely going into year-end, as well as the HUI chart. Gold stocks have basically been trading sideways all year—mostly between 185 and 210, a very narrow range even though it does not look that way on the chart. All the action this year has been with the junior explorers, and thankfully we bought a good mitt-full in the past year or so.

The bullish scenario of this chart is that since the summer rally from July 4 (and a summer rally that most say would not happen), we have moved above the 200-day moving average, and it has been acting as support. Important is that the 200-day MA has also turned up.

Shorting 101

Sometimes it takes a weird or strange event to triggers a person to delve deeper into what happened, and why. Such was the case with the Zonte short contest, which surprised me in what I learned. I am certain that 98% of investors have little clue about this—especially with low priced stocks on the TSX Venture and I would say the OTC also.

Zonte Metals Inc. (ZON:TSX.V)

Recent price $0.17

Entry Price $0.15

Opinion: Strong Buy

I list this as a strong buy because we are back down near our entry price and I do not believe these low prices will last much longer, mostly because volume has died at these levels, so means few will get a change to buy here. The average volume over last three days was 53,000, or a mere $9,000 of trading.

With the Zonte short contest there were predictions all over the board, but in general there was a group around 1.5 million and another down around 400,000. I was in agreement with the higher group, mostly because the large amount of Jitney shares (about 750,000) moved during the selloff. Jitney is not a trading house but is used to move stock between two brokers or broker houses—for example, between RBC and Cannacord. It made sense it was moved to facilitate shorting.

I thought short volume would be between 800,000 to 1.5 million because of this, and the selling was mostly done through "Anonymous." That is normally how stocks are shorted.

The actual number reported for short data for Oct. 15 was 312,100.

This seemed way too low to me so I started looking around on IIROC on how short trades are entered or recorded and I found a couple astonishing surprises.

This is the executive summary:

"Any order to sell a security which the seller does not own either directly or through an agent or trustee must be marked 'short' at the time of entry to a marketplace. An exception to this requirement is when the order is from an account for which purchase and sell orders are designated as 'short-marking exempt'."

If it is not marked as short, I wonder if a broker temporarily owns stock if he obtains it with a Jitney from another broker, and then when the short trade is complete he "Jitneys" the stock back to that broker. Or would that be considered borrowed stock?

But most revealing is the short exemption rule:

1.2 "Short-Marking Exempt" Order Designation

UMIR defines a "short-marking exempt order" as an order for the purchase or sale of a security from an account that is:

- an arbitrage account;

- the account of a person with Marketplace Trading Obligations in respect of a security for which that person has obligations; or

- a client, non-client or principal account"

So, market makers do not have to report shorts. No surprise here, but these next are the key takeaways:

- which order generation and entry is fully automated, and

This would mean computer trading does not have to mark short trades, and we know how large computer trading has become, even on TSX.V penny stocks.

- which, in the ordinary course, does not have, at the end of each trading day, more than a nominal position, whether short or long, in the particular security; or

- a principal account that has acquired during a trading day a position in a particular security in a transaction with a client that is unwound during the balance of the trading day such that, in the ordinary course, the account does not have, at the end of each trading day, more than a nominal position, whether short or long, in a particular security.

Thus, so as long as the trader or broker covers most of the short position the same day, it is not reported as short.

This is why we see, and I have often seen with ZON (as with other stocks), a flurry of trades in the last 30 or 40 minutes of the day, often in the last five minutes.

For example, about 150,000 shares traded last 15 minutes on the high volume day. All the shorting on ZON was done on those two high volume days, and I would bet that, in both cases, most covered same day, except the 312,100 reported today.

Garibaldi Resources Corp. (GGI:TSX.V)

Recent Price $3.70

Entry Price $0.21

Opinion: Hold

We have already taken very good partial profits and I suggest holding remaining positions long term. GGI made a very good move today announcing a $10 million financing at $3.15 per share and a full warrant, but much higher at $4.50 per share good for two years.

Steve Regoci has done an excellent job moving this forward and creating huge shareholder value. They will now have a strong treasury no matter what the drill results and how the stock reacts. This financing will have to close before they announce first drill news.

This has to be the most extraordinary drill speculation we have seen this year—maybe in many years—from $0.20 to $4.00 without reporting a drill result, just core visuals.

I would not be surprised to see a sell-off on drill news—buy the rumor, sell the news—but we are at such a high level a correction back to the $2.00 area is not a big deal from our entry price.

NeutriSci International Inc. (NU:TSX.V; NRXCF:OTCQB)

Recent Price $0.10

Entry Price $0.18

Opinion: Hold; sell around 15 cents

NU closed a $325,000 financing at $0.07 and the stock has been edging higher since. This has not worked out at all as I first believed, so I will look for some further strength to around $0.15 and sell.

Stompy Bot Corp. (BOT:CSE)

Recent Price $0.04

Entry Price $0.13

Opinion: Hold

Something is up, with big volume and a move-up in price. Maybe they are going to do a financing, so watch for that news. If so, there might be news to follow?

Avino Silver & Gold Mines Ltd. (ASM:TSX.V; ASM:NYSE.MKT; GV6:FSE)

Recent price $1.86

Entry Price $1.42

Opinion: Buy stop/loss at $1.60

Avino reported consolidated production highlights for Q3 2017 compared with Q3 2016:

- Silver equivalent production increased by 17 per cent to 760,756 ounces;

- Gold production increased by 47 per cent to 2,673 ounces;

- Silver production decreased by 10 per cent to 368,456 ounces;

- Copper production increased by 6 per cent to 1,106,305 pounds.

"We are pleased to report a strong quarter and that we are on pace to reach our budgeted production targets for 2017. Our expansion is on schedule and I'd like to thank our hard-working staff, both in Mexico and Canada, for their efforts," said David Wolfin, president, CEO & director, Avino Silver & Gold Mines Ltd.

I like the chart, as we are right at a bottom around $1.85, tested a few times, so a good buy level. If we do see year-end weakness, keep a close stop/loss at $1.60.

Smartcool Systems Inc. (SSC:TSX.V)

Recent Price $0.07

Entry Price $0.04

Opinion: Buy

SSC released the results from another trial or initial installation at a quick-serve restaurant in Kingston, Jamaica, that will lead to another chunk of good sales revenue.

The installation was completed on Aug. 10, 2017, and electrical power consumption was then measured at the two Mitsubishi FDC680 KXE6 Heat Pumps cycling through two weeks in bypass and four weeks with Smartcool active. Panoramic Power sensors were used and yielded a straight active/bypass comparison showing an average daily reduction of 126kWh over the period. At the effective current utility rates in Jamaica, the annual financial savings is anticipated to be approximately $10,500 USD. Based on the customer capital cost, it is anticipated that payback will occur in less than 18 months.

Ted Konyi, CEO, commented, "This is another great result for Smartcool and our customer. This particular installation was completed for a franchisee of one of the top five fast food chains in the world and our customer operates 60 fast food (QSR) locations in Jamaica. With the high cost of electricity in Jamaica and most island nations, this installation represents a win-win-win for the customer, the environment and Smartcool. QSR's represent over 30% of all restaurant operations with over 500,000 locations worldwide. Although economic results will vary based on ambient temperatures and utility rates, this segment represents a very large opportunity for Smartcool."

Just a quick crunch on raw numbers: Based on payback, it looks like each installation would be about US$15,000 times 60, which equals around $900,000, which is a significant deal for a company with a $14 million valuation. The $0.07 area looks to be support on the chart right now.

Ron Struthers founded Struthers' Resource Stock Report 23 years ago. The report covers senior and junior companies with ample trading liquidity. He started his Millennium Index of dividend stocks in 2003 - $1,000 invested then was worth over $4,000 end of 2014 and the index returned 26.8% in 2016. He retired from IBM after 30 years in customer service, systems and business analyst, also developing his own charting software. He has expertise in junior start-ups and was a co-founder of Paramount Gold and Silver.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Ron Struthers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Zonte Metals, Smartcool Systems, Neutrisci, Avino Silver & Gold. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: Smartcool Systems. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Smartcool Systems and NeutriSci International, companies mentioned in this article.

Charts and images provided by the author.

Struther's Resource Stock Report Disclaimer:

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.