Gerardo Del Real: This Gerardo Del Real with Resource Stock Digest. Joining me today is CEO of URZ Energy Corp. (URZ:TSX.V; URZZF:OTC), Mr. Glenn Catchpole. Glenn was a member of the board of directors and the Chief Executive Officer of Uranerz Energy Corp. from 2005 until 2015 when the company was sold to Energy Fuels for more than $150 million, creating the largest integrated uranium producer in the United States. URZ is a uranium exploration and development company that is primarily engaged in the evaluation, acquisition, and development of prospective ISR uranium properties in the United States. The company recently completed its IPO and commenced trading on July the 7th under the ticker symbol URZ on the TSX Venture Exchange. Glenn has been active in the uranium solution mining industry since 1978, the year I was born, holding various positions including well field engineer, project manager, general manager, and managing director of several uranium solution mining operations plus has served as a director on the Uranerz Energy Corporation and Energy Fuels board of directors. That's a mouthful there, Glenn. Thank you for hanging in there and thank you so much for your time today.

Glenn Catchpole: Well thank you very much, Gerardo. I really appreciate having this opportunity to join you today. Before I start responding to your questions, I want to point out that some of my responses may contain forward looking statements that may turn out over time not to be accurate.

Gerardo Del Real: Excellent, excellent. Thank you very much, it's important to get the technicalities out of the way. I touched on your extensive experience there very briefly. Could you share with us a bit more about your background? There's a lot there.

Glenn Catchpole: Sure, I'd be glad to. After I received a Bachelor's and Master's degrees in engineering, completing military service, and receiving my certification as a registered professional engineer, I went to work as a senior hydrologist in 1976 in the Wyoming state agency that regulates uranium mining. From there I had a succession of jobs in private industry in the in-situ recovery mining business with such companies as the original Uranerz USA, a German company, Cameco, Uranerz Energy Corporation, a U.S. corporation, and I'm now the CEO of URZ Energy Corp. Along the way I moved from senior positions in operations to senior management position. While working for Cameco, I was a general manager of the Inkai ISR uranium mine located in Kazakhstan. That mine is currently the largest uranium mine in the world. Good or bad, I now have 40 years of continuous employment in the ISR uranium mining industry.

Gerardo Del Real: Wow, over 40 years now. You're the last person I need to tell, Glenn, but obviously the resource space is a very cyclical one and there's no substitute for the kind of experience that you have. You've also put together a very experienced team here at URZ. Can you share with us some of the background of the team in place at URZ, being that it's such a new company?

Glenn Catchpole: You bet. At present senior management consists of myself as the CEO, Todd Hilditch as Executive Chairman, and Bryan McKenzie as our CFO. The three of us are also board members on the board of directors of URZ.

Mr. Hilditch has over 20 years of experience in the natural resource sector and has held the position of President, CEO, and Director of numerous TSX Venture listed companies included Salares Lithium Inc., which was merged with Talison Lithium to become the largest producing lithium company in a $340 million merger. Mr. Hilditch has been President and CEO of Terraco since inception in 1995 and manages all aspects of the day to day business of Terraco. Mr. Hilditch graduated from the Rensselaer Polytechnic Institute in Troy, New York, with a Bachelor's Degree of Science in Management, majoring in finance.

Mr. McKenzie brings a broad and comprehensive knowledge of finance, accounting, auditing, tax, and public markets. Mr. McKenzie has held the position of Chief Financial Officer for numerous publicly listed companies including Salares Lithium Inc., which merged, as I mentioned before, with Talison to become one of the world's largest lithium production companies. Mr. McKenzie has been directly involved in corporate transactions which includes mergers, acquisitions, and financing in excess of half a billion dollars. That's with a B.

Gerardo Del Real: Wow.

Glenn Catchpole: Prior to that, he worked at a leading mid-sized accounting firm where he specialized in the mining and technology sectors. Mr. McKenzie is a Chartered Accountant. Todd Hilditch, Bryan McKenzie, and myself are also members of the board, as I mentioned earlier. And Sandra MacKay and Ben Leboe are independent URZ Energy directors. Sandra worked for Uranerz Energy Corporation as inside legal counsel and corporate secretary. And Ben was the Chief Financial Officer for Uranerz Energy Corporation. Uranerz Energy Corporation merged Energy Fuels in 2015 with the latter being the surviving entity.

Gerardo Del Real: You've obviously put a very successful band back together, the band being the Uranerz Energy Corp band, obviously. You were very successful there. I mentioned in the introduction that URZ recently completed its IPO. Many people, many of the smartest people in the business, I spoke with Jeff Phillips the other day who feels the same way, believes that we're coming out of the bottom of what's been a very tough uranium cycle and entering a new bull market for uranium, though obviously it's very, very early days. Why go public now, Glenn? Do you share a similar sentiment?

Glenn Catchpole: Well I do share a similar sentiment and URZ views this current depressed uranium market to be the optimum time to search for and acquire good uranium properties and even processing facilities with expectation that down the road the spot and term price will recover. This will allow us to develop our key properties and put them into production quickly. We also look for properties that have approved mining and licensing permits, allowing a short path to production.

Gerardo Del Real: Excellent, excellent. So you're also looking at facilities. Let's talk about the current assets in place and the strategy moving forward. The flagship as of now is the Gas Hills project, which is located in the Gas Hills uranium district in Wyoming, of course. Can we talk a bit about the Gas Hills project?

Glenn Catchpole: Sure. The Gas Hills uranium district in west central Wyoming was one of the most prolific uranium mining districts in the state during the 1950s, '60s, and '70s and on into the '80s. In excess of 100 million pounds of uranium have been mined from this district and there's a significant amount of uranium remaining to be extracted when the prices improve. The properties in the Gas Hills that we acquired from Energy Fuels in 2016 came with a large database of electronic logs, geologic maps, cross sections, core samples, technical reports, environmental studies, and environmental permitting documents. At one time a former owner of the Gas Hills properties prepared and obtained the regulatory permits needed for mining. These permits are no longer active but will serve as a good starting point for re-permitting the same properties.

Gerardo Del Real: Excellent, excellent. Now, Glenn, could you please tell me more about the resource in place and the potential to increase that resource?

Glenn Catchpole: The Gas Hills property actually consists of five properties that were explored back in the '50s, '60s, '70s, and '80s and more recently in the 2007 to 2013 timeframe. A third party 43-101 report completed earlier this year on our properties in the Gas Hills show that we have 4.7 million pounds of indicated resource and 2.5 million pounds of inferred resources. We are quite optimistic that the resource numbers will increase in the Gas Hills with further exploration. Current thinking is that as uranium demand increases and prices rise, the Gas Hills properties would be our first properties that we'll bring on line unless we acquire richer and more economic properties in the meantime.

I should also mention that we think with good reason, that properties of our uranium resources at Gas Hills can be extracted using the economical and environmental friendly ISR mining method.

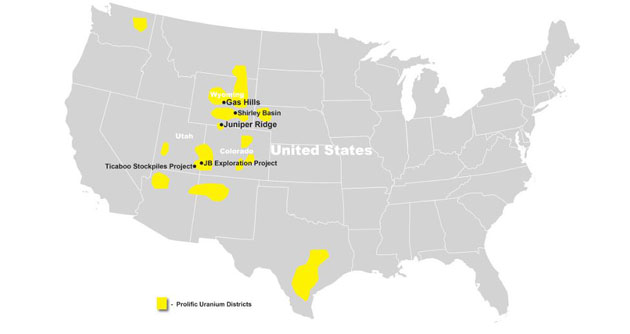

Gerardo Del Real: Now Glenn, in addition to Gas Hills, you also have the advanced stage Juniper Ridge project, which also has a resource in place, the Shirley Basin properties in Wyoming, and then also properties in Utah and Colorado. What's the strategy moving forward to develop those assets?

Glenn Catchpole: You are right. The Juniper Ridge property has a 43-101 uranium resource base of some 6 million pounds indicated and 182,000 pounds inferred. Juniper Ridge and our properties in Utah and Colorado lend themselves to conventional mining with infrastructure in place such to be economical to bring into production as spot and term prices increase.

As for Shirley Basin, this historic uranium mining district produced some 60 million pounds of uranium up until the early 1990s. We own three separate blocks of federal mining claims in this district plus two state leases and we are currently reviewing the data we have on these three blocks to determine our next step in this area which might include a drilling program. There's potential on our three blocks of claims for additional uranium pounds and one of our claim blocks is adjacent to mining claims that Cameco has in the Shirley Basin.

Gerardo Del Real: The first two boxes that I always need to check off when I'm evaluating a company, Glenn, are the people and then the share structure. You obviously have a very, very accomplished team that has, frankly, had a lot of success in the area that you're looking to operate in again. What does the share structure and the cash position look like right now?

Glenn Catchpole: Well, right now, URZ has a little over 36 million fully diluted shares outstanding in the marketplace and a cash position of about CA$1.7 million as of the end of August.

Gerardo Del Real: Now obviously that tight share structure is going to give you a lot of flexibility to bring in other assets at a time where your deep network can leverage its reach at very, very opportunistic prices. You mentioned that earlier. You also mentioned that you're looking to add properties and possibly even facilities to the portfolio. Where is that now, Glenn? Is that a part of the near-term strategy?

Glenn Catchpole: Most definitely. It's a key aspect of our business plan to seek out and acquire quality uranium properties with our focus mainly in the western U.S. We believe that now is the time with spot and term prices near historic low levels to build a portfolio of good uranium properties that can put into production with a positive cash flow at the appropriate time. And I would also like to add this was our business plan with Uranerz Energy Corporation when we put that company together back in 2005. A lot of companies there were quite active and they were trying to pick up pounds and they did, but a lot of them didn't focus on the quality of the pounds.

They just took whatever was out there and we focused, knowing the ISR mining business and that method and what the operating costs can be, all those components, we went for the properties that we felt comfortable could be put into production. And that led to the building of the Nichols Ranch mine in the central part of the basin of Wyoming that we put into production and was a successful operation and they are expanding there. It now belongs to Energy Fuels but my point is that with our team we're focused on not just on acquiring properties but acquiring good properties that can be developed later on.

Gerardo Del Real: Wonderful, and now for those that are not familiar or were not familiar with the Uranerz story, I believe when you went public it was a CA$0.25 per share price and it eventually reached a high at its peak during the uranium boom of approximately $8 per share. Just a little context for everybody that may be new to the success that this team has had.

What can shareholders expect from URZ in the next 6 to 12 months, Glenn? It's obviously a very exciting time for the company. You just completed a financing, you're active in your backyard, what can everybody expect from here on out?

Glenn Catchpole: That's a good question. I'm delighted to be able to give an answer to that because it is key to who we are and what we're doing. URZ plans to acquire additional quality uranium properties in the U.S. and to perform exploration on those properties where we can expand our resource numbers at minimal exploration expenditures. We will also be reviewing our significant database on our Gas Hills properties with the intent of developing a preliminary mine plan showing conceptual design and the associated cost estimates.

Gerardo Del Real: Excellent. Glenn, I look forward to having you back on. There's obviously a pipeline of news that's going to be rolling out here in the next few quarters and I definitely hope that you can come back on and share some of those details as those events materialize.

Glenn Catchpole: Well, Gerardo, I want to also thank you very much for this opportunity to tell our story. It's important for us to get our word out and we appreciate the interest you've taken and looking forward to a strong relationship with you in the future.

Gerardo Del Real: I really appreciate that, Glenn. The success of your team speaks for itself, it's a very tight share structure, you have very supportive long term shareholders, you're in a part of the country that is a great jurisdiction for what you're looking to do, and again, you've done it before so I'm definitely looking forward to following the story and keeping up with it. Thank you very much, Glenn.

Glenn Catchpole: Thank you, Gerardo.

For the past decade, Gerardo Del Real has worked behind-the-scenes providing research, due diligence and advice to large institutional players, fund managers, newsletter writers and some of the most active high net worth investors in the resource space. He brings his extensive experience to the public through Outsider Club, Resource Stock Digest, Junior Mining Monthly, and Junior Mining Trader.

Want to read more Energy Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Glenn Catchpole: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: URZ Energy. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: URZ Energy. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned are sponsors of Streetwise Reports: Energy Fuels Inc. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of URZ Energy Corp., a company mentioned in this article.