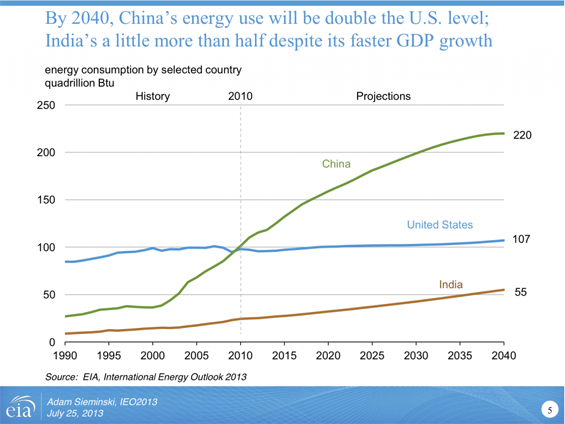

The Energy Information Administration (EIA) recently released its International Energy Outlook 2013 (IEO2013). While the EIA doesn't have a sterling track record for predictions, many organizations make decisions at least partially based on EIA projections. Therefore the organization's forecasts are worth reviewing.

Of particular interest to me were the agencies forecasts about China's energy demand. Over the past decade, China has become the world's largest energy consumer, as well as the world's largest emitter of carbon dioxide. Chinese coal consumption is up 157 percent since 2002, and it now consumes over 50 percent of the world's coal. Its oil consumption rose by 5 million barrels per day (bpd) in the past 10 years, to nearly double the level of 2002.

But according to the EIA, we haven't seen anything yet:

In order to attempt to meet this demand, China truly has an "All of the Above" energy strategy. Renewable energy advocates like to point to China's huge investments in that sector as if to say that China is leading the way toward a clean energy future. But China is making major investments across their energy sector, including investments in many new coal and nuclear power plants. (China is expected to account for 40 percent of the world's new nuclear power capacity over the next three decades).

I know a lot of people who would say that the forecast is silly, because there simply won't be enough energy to enable that sort of growth. A friend recently said to me "It's a zero-sum game." I wouldn't go quite that far yet, but to the extent that the global acquisition of energy does become a zero-sum game, that means there will be fierce competition—much more so than we have seen to date—for the world's energy supplies. The last decade saw $100/barrel oil as the new norm. How high might oil prices go if China grows its consumption by another 5 million bpd?

At the end of every year, I list my Top 10 stories for the year, and I make predictions for the upcoming year. And every year, China ends up pretty high on both lists. I have stated on many occasions my belief that China's growth is presently the single largest driving force in the global energy markets. If the EIA forecasts are even in the ballpark, that's going to continue to be the case for many years to come.

Robert Rapier

The Energy Collective