Lion One Metals Ltd. (LIO:TSX.V; LOMLF:OTCQX; LLO:ASX; LY1:FSE) has begun mining near-surface, high-grade gold bearing mineralization at a recently discovered lode at its Tuvatu project in Fiji.

Miners have made 14 cuts for an estimated 475 tonnes of material for the company's inventory stockpile, which will be the initial feed for its processing facility there, which is under construction.

In a December research note, ROTH Capital Partners analyst Mike Niehuser noted that the company also discovered another mineralized zone to the east of the URA1 gold lode.

"The combination of discovering distal mineralization, with the reorientation of the north-to-south lodes, may lead to the realization of a larger mineralized gold system open to expansion," Niehuser wrote.

ROTH has a Buy rating and a CA$2.50 per share target price on the stock, which would be more than triple Tuesday's price of CA$0.84 per share.

In February, Lion One noted that samples from the first cut taken from the lode averaged 14 grams per tonne gold (g/t Au).

ROTH has a Buy rating and a CA$2.50 per share target price on the stock, which would be more than triple Tuesday's price of CA$0.84 per share.

Technical analyst Clive Maund of CliveMaund.com noted in December as well that the stock looked like a "good value" then at CA$0.79.

"Anyone holding should stay long," he said at the time. "This is a good point at which to make fresh purchases."

The Catalyst: Analog to Another Rich Fiji Mine

When Lion One's mining lease at the project was extended last year through February 2035, Niehuser called Tuvatu "one of the highest-grade gold mines in the world."

"We believe that Tuvatu is competitive with Fiji's Vatukoula, which has operated for over 85 years," Niehuser wrote. "The granting of the Tuvatu Mining Lease (SML 62) de-risks the project, making it attractive to major mining companies."

Technical analyst Clive Maund noted in December as well that the stock looked like a "good value" then at CA$0.79.

Vatukoula, which means "gold rock" in Fijian, shares the same geological setting, an alkaline-epithermal gold deposit, as Tuvatu. Operated by Vatukoula Gold Mines, it has a resource of 3.8 million ounces (Moz) Au.

Tuvatu is on the island of Viti Levu in the archipelago nation. A September 2020 Preliminary Economic Assessment (PEA) outlined an indicated resource of 1,007,000 tonnes grading 8.48 g/t Au for 274,600 ounces Au and an inferred resource of 1,325,000 tonnes grading 9 g/t Au for 384,000 Koz Au. The study used a cut-off grade of 3 g/t Au.

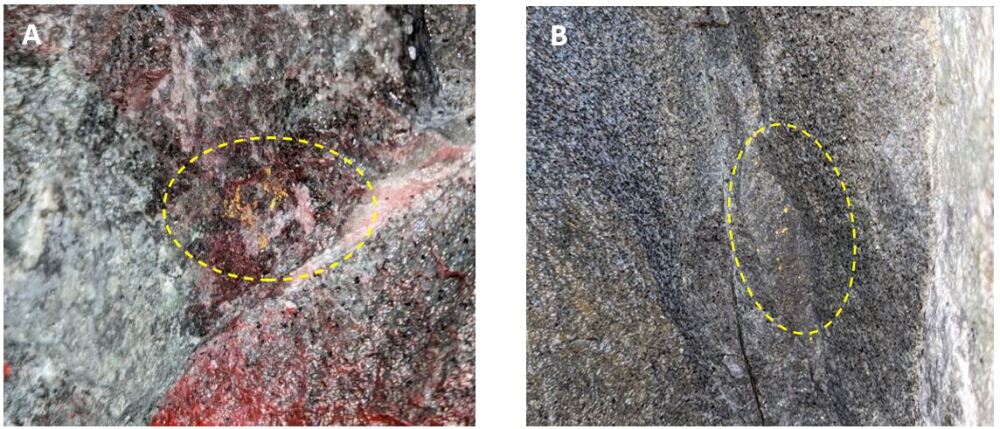

Pictures released by Lion One (left) show visible gold in samples collected from the new lode.

Lion One President and Chief Executive Officer Walter Berukoff founded Miramar Mining, which developed the 10 Moz Hope Bay gold project in Canada's Arctic. He sold Miramar to Newmont in 2007 in an all-cash deal worth CA$1.5 billion, a deal that came on the heels of him and his team selling Northern Orion Resources to Yamana Gold for a little more than CA$1 billion.

Niehuser said Tuvatu's neighborhood in the Navilawa Caldera is hard to beat.

"Beyond Tuvatu, given early exploration results within the Navilawa Caldera, we believe that there is the potential for an additional three to four Tuvatu-like prospects" in the area, Niehuser wrote.

Looking Ahead to 2023

The processing plant is expected to begin production as early as the second half of this year.

Lion One plans to operate at an initial production capacity of 300 tonnes per day for the first 18 months before increasing capacity to 500 tonnes per day in mid-2025. Initial mining will focus on the near-surface resource while advancing underground development.

The drilling campaign this year will be focused on grade control of the near-term production blocks, identifying separate mineralized systems within the greater Navilawa caldera, and completing geophysical surveys to delineate further drill targets, the company said.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Lion One Metals Ltd. (LIO:TSX.V; LOMLF:OTCQX; LLO:ASX; LY1:FSE)

The new lode was found 75 meters into the development's decline and was defined by underground mapping, chip-channel sampling, and diamond drilling.

Lion One is using airleg mining at Tuvatu, allowing the company to deliver low-cost tonnage at minimum mining widths of 1.8 meters and a rate of advancement of 4 meters per day.

The mineralization mined at Tuvatu so far represents the first modern extraction from the deposit, Lion One said.

Ownership and Share Structure

About 14% of the company is held by insiders, about 6% by institutions, about 20% by other investors, and about 60% is retail.

The CEO Berukoff owns about 11.8% or 20.9 million shares, according to Reuters. Franklin Advisers Inc. owns 4.27% or 7.56 million shares.

Lion One's market cap is CA$148.59 million with 176.9 million shares outstanding, 155.66 million of the free-floating. It trades in a 52-week range of CA$1.66 and CA$0.59.

Sign up for our FREE newsletter

Disclosures:

1) Steve Sobek wrote this article for Streetwise Reports LLC. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Lion One Metals Ltd. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.