Teal Drones, a subsidiary of Red Cat Holdings has secured a contract from an unnamed NATO country to supply Ukraine with 15 military-grade drones. The 100% American-made Golden Eagle units deploy stealthily to provide seamless monitoring.

I have been following the progress of Puerto Rico-based and Nasdaq-listed Red Cat Holdings Inc. (RCAT:NASDAQ) in recent news for a while now; in part, as a key colleague of mine — with whom I regularly share ideas — has kept me in the loop and encouraged me to take this BIG story more seriously.

So part of my Sunday was spent on a very lengthy Zoom call with him and RCAT's Chairman and CEO Jeff Thompson. As Thompson explained the company's recent news and its competitive position/advantages, it was impossible not to become as excited over this story as I have been told for weeks I should be.

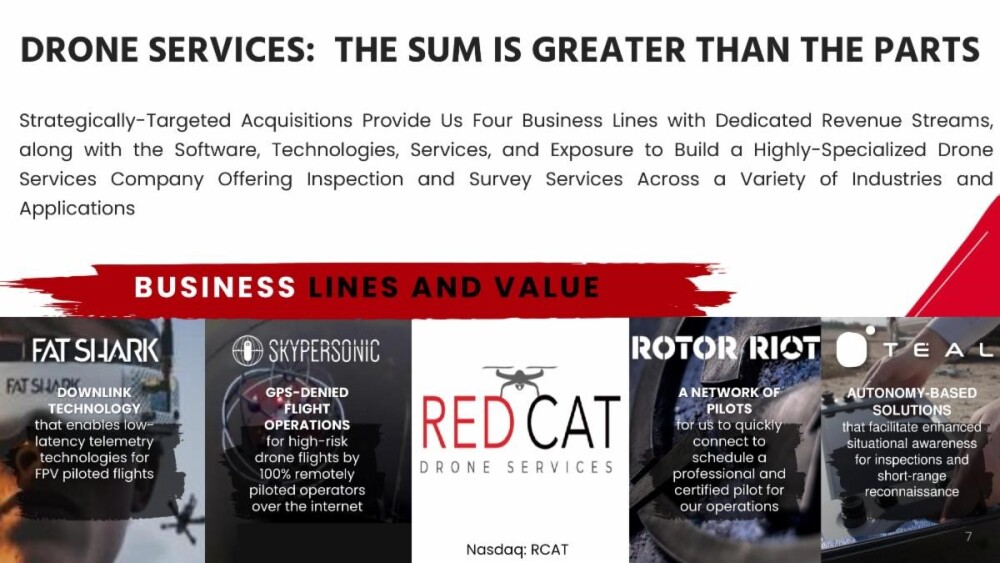

Red Cat has been seeking to establish itself as a new leader in U.S.-manufactured and sanctioned drones and related services. Through its four different subsidiaries, it serves a variety of markets and niches: the two most important being their drones and related services for civil engineering, infrastructure and the like (chiefly, Skypersonic) and for military/homeland security (Teal).

This is an industry which — as we discussed yesterday — had a big, speculative pop several years back. But a combination of some shadiness among some of the players here and — for a while — Chinese entities completely overwhelming and taking over this area has had most real and imagined drone companies in North American markets in the dumps in the more recent past.

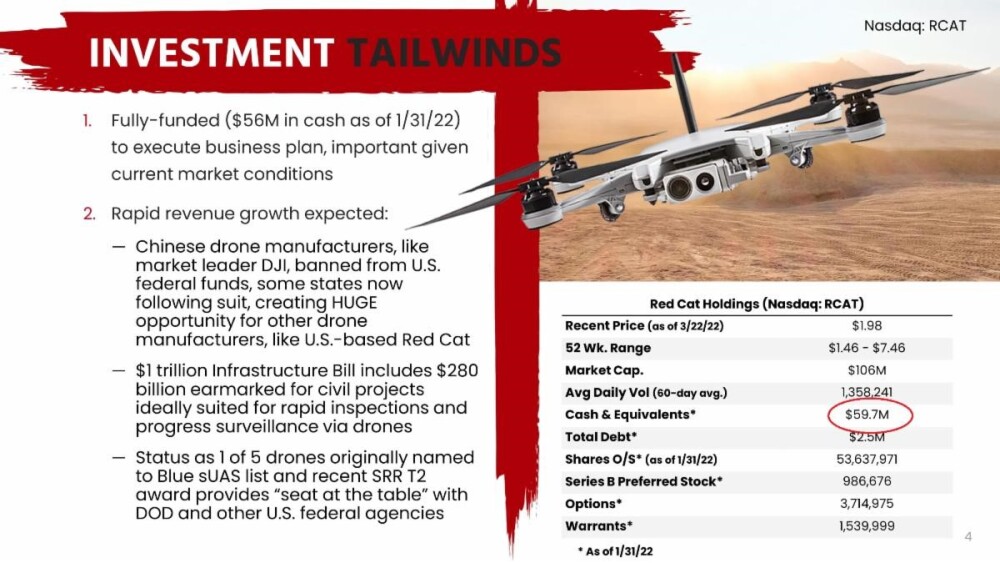

But it’s a changing world. Chinese-made drones and related software, etc. services associated with them are BANNED for purchase or use by the recent infrastructure bill. Beginning in July, those in present use in some applications must by law start being phased out. In just one of numerous main points I could give you on this, the Border Patrol alone presently has over 2,000 systems in use now made and serviced by Dajiang Innovations, or DJI, China’s leading drone maker. They must now begin being replaced; together with others.

Further, no new Chinese-made drones (and their related software capable of gathering all manner of information) can be bought with federal money; and one by one, individual states are rapidly following suit for their purposes.

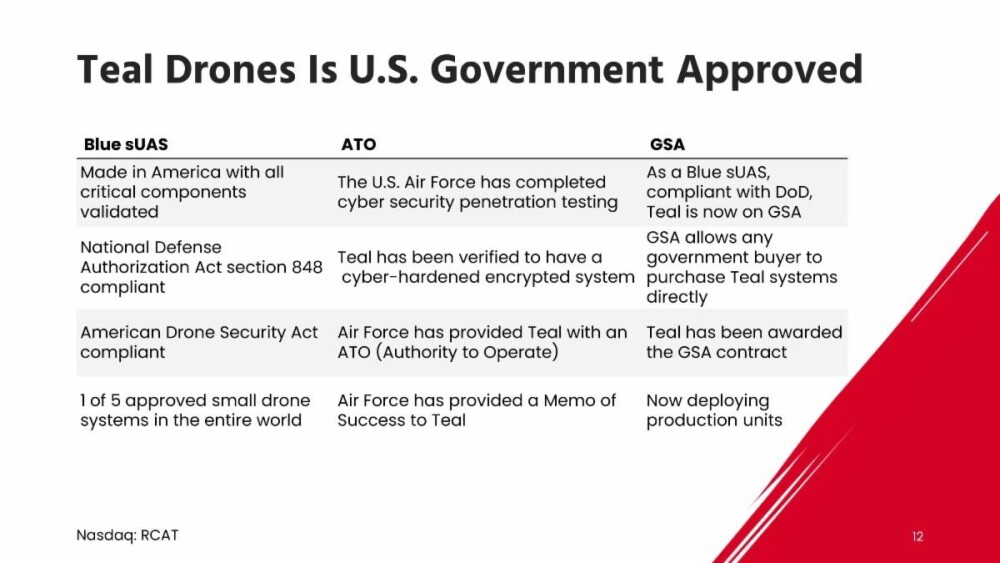

This suggests Teal especially could be in for a LOT of business in the months and years ahead, as the company is one of but five small drone system makers with a “seat at the table” and special designation by the Department of Defense.

Back a few days before Christmas, the company announced a five year, $90 million award from the Border Patrol. Just a couple weeks ago, Teal was invited to take the next step to qualify for a potential DoD contract to make small surveillance drones for small army platoons in the field (see that news here.)

This follows the company having been previously been awarded $1.5 million by the Pentagon to further its prototype design work.

Switching quickly for a minute back to domestic industrial, infrastructure and related uses, RCAT’s Skypersonic has cutting-edge, patented technology allowing its drones to be in isolated areas and still have complete GPS location ability.

This augurs well for future business here, as gobs of money appropriated for infrastructure repairs, for instance, will be spent on such things that can most efficiently and inexpensively examine sewers (three million miles of them in the U.S., Thompson reminded us) undersides and nooks and crannies of bridges, and the like.

The value proposition here is mind-blowing when you look at Red Cat's potential business in the months, to mention years, ahead, I.M.O.; which is why I am starting it as a BUY and adding it to my list of growth-oriented companies.

As with its drone peers specifically and small-cap stocks generally, the last year has — until lately — been a steady slide downward for RCAT's share price. But — though most of the share price gain was surrendered since — that March 14 announcement clearly got some attention. That has helped further in the cause of flattening the downward trajectory of the stock's 50-day moving average as you see above and now turning it upward.

And fresh news out mere moments ago looks likely to cause a sharp gap higher for RCAT shares at today's open.

As you can read right here, the company just announced "...an order for 15 Golden Eagle drone units, plus spares and training, from a NATO (North Atlantic Treaty Organization) member country that has committed them to deployment in Ukraine."

As I am sending this out, it appears that shares would open in the $2.40-$2.50 area; still a screaming buy, I.M.O.

Whether a pop such as this is quick and dissipates yet again, who knows...but such near-term potential volatility is relatively meaningless in considering the longer-term potential here.

Finally, consider that of RCAT's roughly $105 million market cap as of Friday's close, HALF OF THAT IS CASH!

Indeed, though there are of course no guarantees, Thompson sees the possibility that more revenues will be coming in sufficiently sooner rather than later so that the company may not have to go to market again for the foreseeable future (RCAT in 2 chunks, in part as it listed on Nasdaq, raised $16 million and then $60 million in the recent past.)

I'll add here that those two financings were done at $4.00 and $4.50, respectively, as I recall; so theoretically, there should be little inclination for profit-taking until we get past those numbers, all else being equal.

I encourage you to spend some time on the company's website, which is chock full of way more details, including a number of videos describing different aspects of the company's businesses.

Chris Temple is editor and publisher of The National Investor. He has had an over 40-year career now in the financial/investment industry. Temple is a sought-after guest on radio stations, podcasts, blogs and the like all across North America, as well as a sought-after speaker for organizations. His ability to help average investors unravel, understand and navigate today's markets is unparalleled, and his ability to uncover "off-the-radar" companies is likewise.

His commentaries and some of his recommendations have appeared in Barron's, Forbes, CBS Marketwatch, Wall Street's Best Investments/The Cabot Group, Kitco.com, the Korelin Economics Report, Benzinga.com, Palisade Radio, Mining Stocks Education, Mining Stock Daily and other media.

Disclosures

1) Chris Temple: I, or members of my immediate household or family, own securities of the following companies discussed in the broadcast: None. I personally am, or members of my immediate household or family are, paid by the following companies discussed in the broadcast: None. My company has a financial relationship with the following companies discussed in the broadcast: None. Chris Temple's and The National Investor disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Red Cat Holdings Inc., a company mentioned in this article.

Additional disclosures

The information contained herein is conscientiously compiled and is correct and accurate to the best of the Editor’s knowledge. Commentary, opinion, suggestions and recommendations are of a general nature that are collectively deemed to be of potential interest and value to readers/investors. Opinions that are expressed herein are subject to change without notice, though our best efforts will be made to convey such changed opinions to then-current paid subscribers. We take due care to properly represent and to transcribe accurately any quotes, attributions or comments of others. No opinions or recommendations can be guaranteed. The Editor may have positions in some securities discussed. Subscribers are encouraged to investigate any situation or recommendation further before investing. The Editor receives no undisclosed kickbacks, fees, commissions, gratuities, honoraria or other emoluments from any companies, brokers or vendors discussed herein in exchange for his recommendation of them.

No Offers being made to sell securities: within the above context, we, in part, make suggestions to readers/investors regarding markets, sectors, stocks and other financial investments. These are to be deemed informational in purpose. None of the content of this newsletter is to be considered as an offer to sell or a solicitation of an offer to buy any security. Readers/investors should be aware that the securities, investments and/or strategies mentioned herein, if any, contain varying degrees of risk for loss of principal. Investors are advised to seek the counsel of a competent financial adviser or other professional for utilizing these or any other investment strategies or purchasing or selling any securities mentioned. Chris Temple is not registered with the United States Securities and Exchange Commission (the “SEC”): as a “broker-dealer” under the Exchange Act, as an “investment adviser” under the Investment Advisers Act of 1940, or in any other capacity. He is also not registered with any state securities commission or authority as a broker-dealer or investment advisor or in any other capacity.

Notice regarding forward-looking statements: certain statements and commentary in this publication may constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 or other applicable laws in the U.S. or Canada. Such forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements of a particular company or industry to be materially different from what may be suggested herein. We caution readers/investors that any forward-looking statements made herein are not guarantees of any future performance, and that actual results may differ materially from those in forward-looking statements made herein.

Copyright issues or unintentional/inadvertent infringement: In compiling information for this publication the Editor regularly uses, quotes or mentions research, graphics content or other material of others, whether supplied directly or indirectly. Additionally he makes use of the vast amount of such information available on the Internet or in the public domain. Proper care is exercised to not improperly use information protected by copyright, to use information without prior permission, to use information or work intended for a specific audience or to use others' information or work of a proprietary nature that was not intended to be already publicly disseminated. If you believe that your work has been used or copied in such a manner as to represent a copyright infringement, please notify the Editor at the contact information above so that the situation can be promptly addressed and resolved.