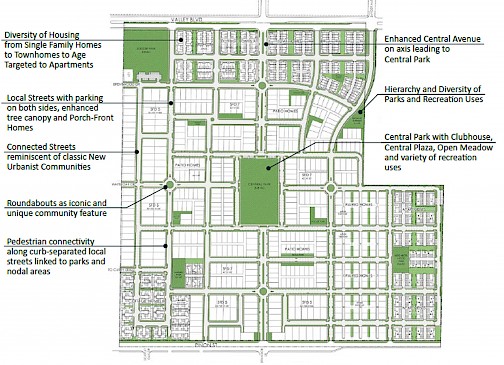

Some of my previous coverage on Greenbriar Capital Corp. (GRB:TSX.V; GEBRF:OTC) focused on their two solar projects and the Sage Ranch property development. Given recent news with Sage Ranch, it has occurred to me that the main reason this stock is so cheap is because investors don't understand or aren't aware of Greenbriar's huge imminent growth potential with Sage Ranch.

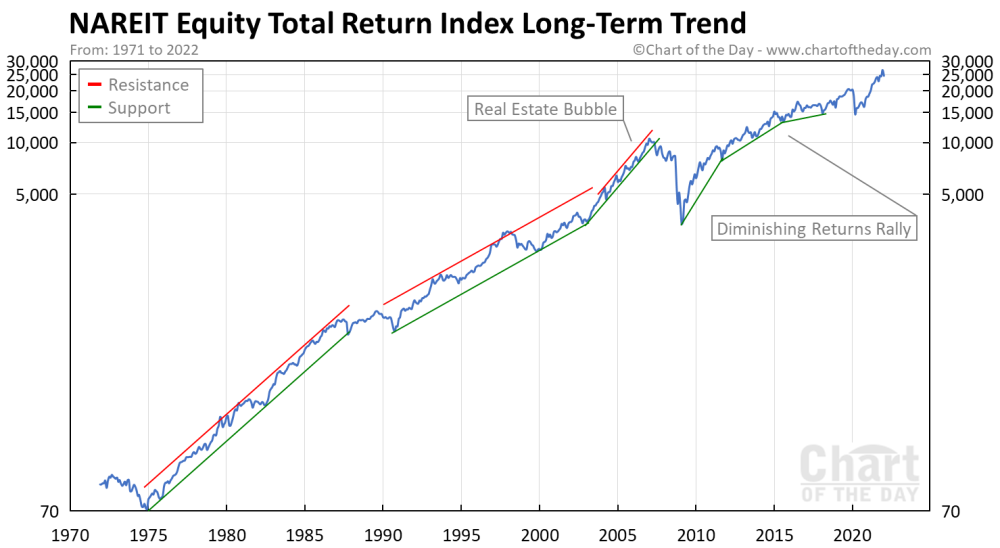

Many Canadian investors will be aware of Real Estate Investment Trusts (REITs). Investors get exposure to real estate with these, but Greenbriar is far better. REITs do not provide dividends but distributions and they are taxed as normal income at your prevailing tax rate. Around 70% of returns are income and the remaining will be either return on capital or capital gains. A good overview of REITs here.

With REITs, you are making limited capital gains from the appreciation in value of their advanced and developed properties. In general, you are reaping the reward of general appreciation over time in real estate values and rental income. I know a couple people involved in starting up REITs. The best investment is if you can find under-developed real estate assets, upgrade these properties and then rent them at much higher rates. It is difficult to find these and most just become part of a REITs larger portfolio so there is diluted positive effect.

You can see in this chart that REITs are good long-term investments like real estate and follow the real estate market very closely. Their average yield now is about 3%. There are some with much higher yields and they are paying much better than treasuries and short term deposits.

The largest value increase with real estate is when a project goes from scratch or raw land to fully developed housing units. It is especially more valuable when you start with a low cost on your land. All of the gains in this valuation are capital appreciation as there is no income at this point, but appreciation from sales. All the gains are capital gains, taxed at the lowest rates, and in the case of Greenbriar, capital gains that will be reflected in the stock price.

Greenbriar started out with Sage Ranch at a very low valuation because they bought the property as a distressed sale after the 2008 real estate crash for $1 million in 2011.

There is a good video that makes a point to investors who don't understand or are skeptical. It will also give you insight to Chief Executive Officer Jeff Ciachurski on how he thinks and operates Greenbriar.

In North America, the Altus Group Ltd. (AIF:TSX) is a premier real estate evaluation company, the go-to company. Greenbriar engaged them after Sage Ranch got full approval. Altus' report on Sage Ranch reveals sales volume of $409 million, net profit of $174 million and NPV of $124 million at a 6% discount rate. Altus gave a land value of $111 million, and remember, Greenbriar paid only $1 million for that land.

In regard to Sage Ranch's valuations, keep in mind that Greenbriar's market cap is a mere $32 million. That's less than one-third of Sage Ranch's land value, giving zero value for the housing and their two solar projects.

On March 30, Greenbriar executed a $40 million mandate agreement with Voya Investment Management LLC, a premier real estate investment firm, for a senior secured construction loan for the construction of the 995-home Sage Ranch sustainable project. Voya will receive a bonus of 2 million three-year Greenbriar common share warrants at $1.25 per share at closing or the same amount plus a $1 million cash breakup fee if the company chooses another lender. Interesting these funds came from Voya's renewable energy sector because Sage Ranch has a zero-carbon footprint.

On the balance sheet, you can only value real estate at its book value, so that is only $1 million for Sage Ranch when we know it is worth more than 100 times more. Like we see with mining development, in the same way Greenbriar has a $20 million operating deficit. This deficit gets eliminated with first cashflow from Sage Ranch. That is beneficial for Greenbriar and shareholders, because that $20 million can offset gains and taxes on the first revenues. Revenues and profits for Sage Ranch will come onto the balance sheet as each unit is sold, so there will be constant revenues, cashflow and profits over the next six years as Sage Ranch is developed.

Sage Ranch will complete all engineering details and break ground in Q3 or Q4 and at that time Greenbriar can accept deposits on the first 160 homes in phase one. Greenbriar is getting very close to revenue generation.

A key to Ciachurski's strategy is to develop projects that can create so much value they can be financed at the project level, avoiding shareholder dilution. For example, the IRR for Sage Ranch is 62%. Most mining projects we come across, you will see around 25% to 35% IRR and occasionally you find one at 50% or better. Sage Ranch has a very strong IRR.

Ciachurski does not push promotion until all development activities are complete and/or on track, which is around now, so I think the story will start getting out. The last time the stock ran to $4.60 was because of exposure among influencers in China. Chinese investors own millions of shares of Greenbriar. The developer for its Puerto Rico Montavla project is the largest Chinese engineering firm. Greenbriar did its Alberta solar deal with West Lake, which is privately owned mostly by large Chinese investment funds. So the Chinese connections and investors are there, it is just a matter of when they step back into the market or some other large investment group that figures out the low valuation and large potential.

An important point about the last 2 million-share financing that Ciachurski makes in the video: There were 500,000 units bought by the chief financial officer and his father, another 500,000 units by Devon Sanford heading the Alberta solar development, and 1 million units by a large real estate family in Toronto that already owned 4 million shares.

Greenbriar has a very strong shareholder base, and I suggest you may want to be part of it. The NASDAQ application should be ready in about two months and it is only a matter of when this stock moves a lot higher. It is very tightly held with strong management and insider ownership and very loyal shareholders. The stock will not be easy to buy in quantity when it starts moving. It is best to buy now, while you can get it very cheap and under the radar.

Greenbriar has the potential to easily increase three- or four-fold from current prices, and of all the companies I currently follow, probably has the least downside risk.

This is also very evident on the stock chart. There is very strong support just under $1.25 that has been tested numerous times in the last two years. The stock has broke out of a wedge pattern or pennant with side ways trading which is still bullish like an upside break out. First resistance is around $1.75.

For 27 years, Ron Struthers, founder and editor of Struthers' Resource Stock Report and Playstocks.net, has consistently beat the comparable benchmarks selecting stocks in the precious metals, oil & gas, clean-tech and disruptive technology sectors. In 2017, 35 stocks in the precious metals sector saw an average gain of 62% and energy clean-tech an average gain of 65%. In disruptive technology, 16 picks saw an average gain of 55%. Past performance is no guarantee of future gains. Struthers leverages his vast network of contacts, approaches investments from a value perspective seeking several 100% gain potential and uses technical analysis to aid in buy and sell levels.

SWR Disclosures:

1) Ron Struthers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Greenbriar Capital Corp. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Greenbriar Capital Corp., a company mentioned in this article.

Struthers Stock Report disclaimer: All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.