Rarely do you get the opportunity to invest in a junior at rock bottom levels at the beginning of what might be a new bull market, with a management team that has been at the core of success story Kaminak Gold Corp. (acquired for CA$520M by Goldcorp, now Newmont Corp. [NEM:NYSE], in 2016). Tectonic Metals Inc. (TECT:TSX.V; TETOF:OTCQB) is backed by a number of blue-chip investors including Crescat Capital (advised by well-known Quinton Hennigh), which has been accumulating in the market recently, pushing their share ownership level to well over 10%, making it the company’s second largest shareholder. Sitting at first is Doyon, one of Alaska’s leading Native Regional Corporations and largest landholder in the state. By working closely with Doyon, Tectonic has taken ESG to a whole new level, garnering media and industry attention.

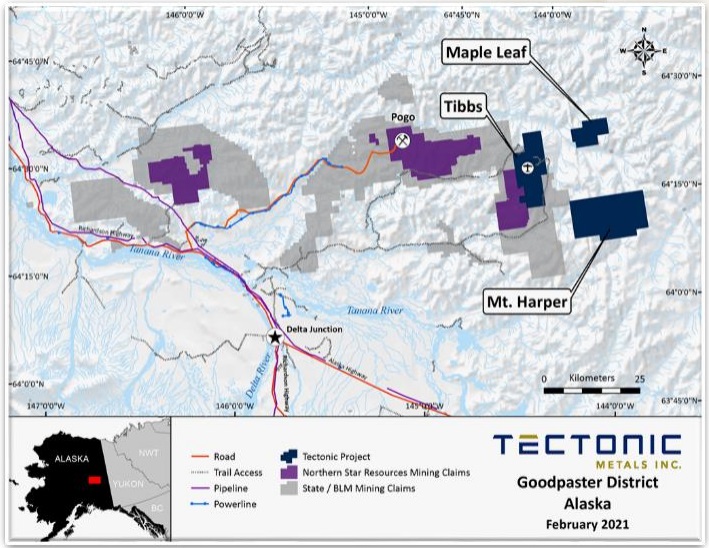

Tectonic owns and explores three projects in Alaska that could each be able to emulate or even surpass the mineral endowments of Kaminak’s Coffee gold project on a stand-alone basis. Eira Thomas, Rob Carpenter, Curt Freeman, and Tony Reda founded Tectonic privately in 2017, and listed the company in September 2019 on the Toronto Venture Exchange. Tectonic raised approximately CA$20M in total over the years, spending most of it on exploration, followed by project generation and acquisition, and despite some impressive sampling and drill results, for whatever reason investors have been reluctant to reward the company’s progress in the open market. To the contrary, every financing completed by Tectonic has been oversubscribed, attracting some of the best resource funds the space has to offer. COVID-19, the Russia-Ukraine conflict, other negative worldly affairs, and something of a malaise in the junior mining sector hasn’t helped their cause either. Trading at all-time lows now, even below the founders cost base, Tectonic presents an attractive value proposition in my view. The company is one of the few juniors smart enough to secure a drill rig last year and is now in the process of formalizing exploration plans, which if successful will hopefully position the company for a significant re-rating, also better reflecting the caliber of its management and projects.

Native, Capital Backing

Tectonic Metals is a mineral exploration company backed by one of Alaska’s largest Native Regional Corporations (Doyon) and sophisticated, highly regarded resource funds (for example Crescat Capital). Tectonic is focused on the acquisition, exploration, discovery, and development of mineral resources from district-scale projects in politically stable jurisdictions.

Tectonic Metals is operated by an experienced and well-respected technical and financial team with a track record of wealth creation for shareholders, as key members of the Tectonic team were involved with Kaminak Gold, raising CA$165M to fund the acquisition, discovery, and advancement of the Coffee Gold Project in the Yukon Territory through to the completion of a bankable feasibility study, before selling the 5Moz gold project to Goldcorp (now Newmont) for CA$520M in 2016. Key people within Tectonic are founder, President and Chief Executive Officer Tony Reda, Strategic Advisor and co-founder Eira Thomas, Chair Allison Rippin Armstrong and recent addition Peter Kleespies, vice president of exploration.

Reda was the VP of corporate development for Kaminak, a company where he basically worked for his entire career from 2005 to 2016 until the buyout. He was instrumental in raising CA$165M, arranging the JV’s/strategic alliances, and overseeing IR and marketing at a high level, as Kaminak was chosen as one of four out of 1,971 TSX Venture companies as Best IR by IR Magazine in 2015. He puts his money where his mouth is, as he owns 4.47M shares of Tectonic himself, and invests all his time and energy into making the company a success.

Mining Legend and strategic advisor Eira Thomas was the president and chief executive officer of Kaminak from 2013 until the buyout. Eira comes from a prolific mining family, as her father Grenville Thomas is a Canadian Mining Hall of Famer, as he and Eira discovered Canada’s second largest diamond mine, Diavik. Eira, along with mining titan Lukas Lundin and well-known former colleague Catherine McLeod Seltzer, founded and leads (since 2018) Lucara Diamond Corp. (LUC:TSX.V) as chief executive officer.

Chair Allison Rippin Armstrong is an industry legend in her own right, as she has over 25 years of experience in permitting, regulatory processes, and environmental compliance, working with Indigenous organizations, resource companies, regulatory agencies, and indigenous, territorial, and federal governments. She served as the vice president of sustainability at Kaminak until it was acquired by Goldcorp in 2016. She also served on the board of Yukon Women in Mining as vice president for three years, is a founding member of the Yukon University Foundation Board and has served on NWT and Nunavut Chambers of Mines as well as a number of working groups for the PDAC, and has won numerous awards in related fields.

Vice President of Exploration Peter Kleespies was involved with the discovery and delineation of several large deposits, among those the 8.5Moz Au Hope Bay deposit in Nunavut that was sold to Newmont for $1.5B in 2007. Peter has over 30 years of technical and management experience in mineral exploration covering North and South America, Australia, and Africa.

Curt Freeman, who also co-founded Tectonic and serves as director, brings over 40 years of experience and is considered to be one of the leading geologists in Alaska and the Yukon. In addition, Tectonic’s board is fortunate to include Mick Roper, another veteran geologist with 40 years of industry experience, most recently with Agnico Eagle. Both of these directors provide invaluable insights and contributions to Tectonic’s exploration programs.

Despite its strong team, projects and current high metal prices, it looks like the Tectonic share price is bottoming now. With the current high inflation environment, the negative real rates, being the main (at least for me) sentiment driver for gold, seem stronger than ever, so it looks like the gold price seems set for a move even higher soon. A rising tide certainly helps with lifting all boats in general.

Some basic information on share structure: Tectonic Metals has a 161.68M shares outstanding, and trades at an average daily volume of 317,926k shares. There are 61M warrants (with almost half expiring before the end of June 2022 and the remaining warrants priced at C$0.17, expiring in June 2023,) and only 1M options (400k at CA$0.33 expiring in July 2025, 400k at CA$0.20 expiring in August 2026), so the fully diluted number stands at 223.69M at the moment. Management and BoD have lots of skin in the game as they hold 17%, Doyon holds 15%, and various resource-focused funds (for example Crescat Capital) hold 31%.

The cash position is estimated at CA$1M, with no debt, and management is looking to raise more soon. The current share price is CA$0.06, resulting in a current, tiny market cap of CA$9.7M, and because of people, projects, backing, and bullish metal sentiment, I believe this little junior could easily become a multi-bagger with the right drill results. Let’s have a look at their projects to see why I believe this kind of potential could be there.

Focusing on Alaska

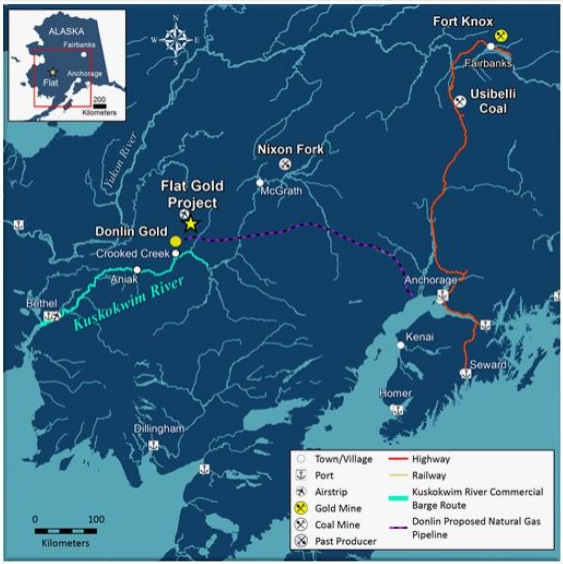

Tectonic Metals designed a project portfolio based on a number of criteria, coupled with a comprehensive exploration strategy. They are focusing on Alaska now. As 52.3% of its land is open for claim staking, it has always ranked as a top mining jurisdiction (13 out of 77 for Policy Perception Index, indicating mining-friendly policies, according to the Fraser Survey of Mining Companies), and has seven producing mines (Pogo, Fort Knox, etc.).

For size, Tectonic is aiming at district-scale projects, which have the potential to generate multi-million ounce deposits. For ESG, they raised the bar even more by positioning Rippin Armstrong as chair, and aim at working together with First Nations very closely, as is illustrated by their agreements with Doyon, a top-tier Alaska Native Regional Corporation. For infrastructure, they are looking for well-established infrastructure and nearby operations. For mineralization, they are looking at large scale, near surface, good recovery type of projects, preferably gold.

Management outlined an extensive exploration strategy, including most well-known methods, to optimize the best targets.

- Their geological approach serves to define the surface geology, and is done by mapping and trenching.

- Their geochemical approach is built around the analysis of geological materials, by sampling target metals and pathfinder elements for large areas to establish mineral potential.

- Their geophysical approach looks for mineral potential sub-surface, by doing all sorts of surveys (IP/EM, airborne, for magnetic, conductivity, radioactivity, density).

- Drilling, to establish actual mineralization, by using three techniques in order of accuracy: rotary air blast (RAB), reverse circulation (RC) and diamond drilling (DD).

This all resulted in the current portfolio of three large exploration projects in Alaska: Tibbs, SeventyMile and Flat, all acquired from Doyon.

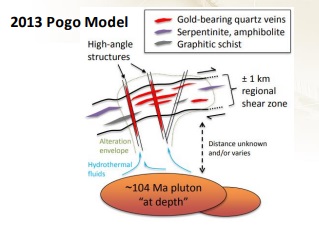

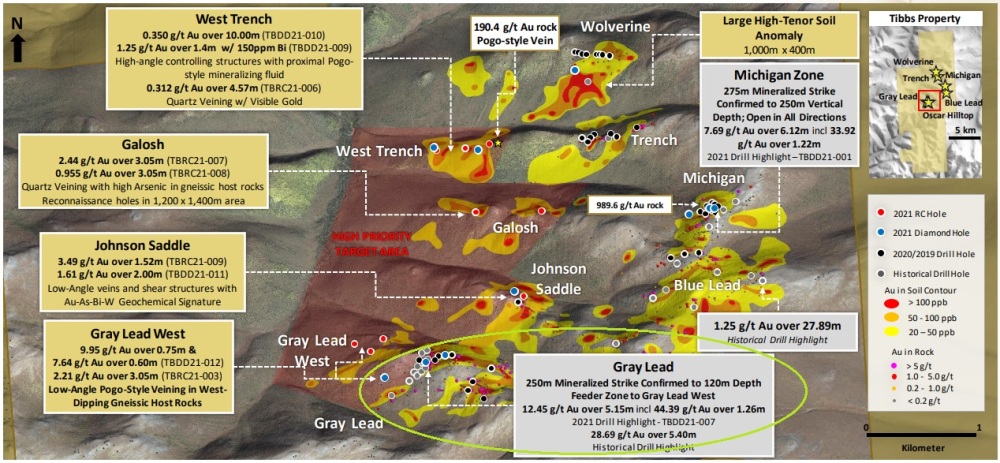

Tectonic’s fully owned flagship is the Tibbs project, covering 29,280 acres, 35km east of the 200koz Au per annum Pogo Mine. High-grade gold mineralization at Tibbs occurs in steeply dipping veins, crossing multiple lower grade low-angle veins similar to the Pogo Mine, which serves as an analogy.

The Tibbs property is close to existing infrastructure and an active mill, and has seen lots of exploration, ranging from sampling, airborne geophysical surveys, trenching to drilling. Drill highlights are 28.95m at 6 g/t Au, 5.3m at 15.7 g/t Au, 5.7m at 19.1 g/t Au, 1m at 104.5 g/t Au, and 5.1m at 12.45 g/t Au. These are very substantial results, and the most impressive drill results were obtained at the Gray Lead area:

Phase 2 drilling already established a 1000m by 350m mineralized zone, where the majority of drill results returned grades over 5 g/t Au, and within this high grade, steeply dipping veins with grades up to 127 g/t Au. It is still early days, but if we would guesstimate a mineralized envelope of 1000m by 350m by 5m by 2.75t/m3 density, this would result in 4.8Mt, and at an average grade of say 5 g/t this could already result in a hypothetical 770koz Au. And keep in mind that this is only a small part of the entire project. Below the Gray Lead target, another target area is located: the Jeans Ridge prospect, where successful sampling up to 50.3 g/t established a 450m long gold-in-soil anomaly.

According to management, a major development of the 2021 Phase 2 drilling program that appears to have been largely ignored by the market was the discovery of four stacked low-angle veins at Gray Lead West. This is significant because the missing piece of the puzzle necessary to confirm Tibbs as a true Pogo analog was a low-angled vein that had previously proven elusive at Tibbs. This matters because the Pogo mine discovery was itself hosted in a low-angle vein. Tibbs now exhibits all of the elements of the “Pogo Exploration Model.” The next step for Tectonic will be to determine whether these low-angle veins exhibit the same swelling or widening tendency as seen at Pogo’s East Deep target.

The 100%-owned Flat gold project is Tectonic’s latest project acquisition and is located 40km north from the 45Moz Au Donlin Gold project, jointly owned and operated by Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) and NOVAGOLD Resources Inc. (NG:TSX; NG:NYSE.MKT). Flat gold consists of 92,160 acres of Native-owned land (Doyon) accessible by air with its 4,100-foot airstrip, which can accommodate a Hercules aircraft, and once on site, there is a network of roads and trails, and materials can be barged to and from via a commercially navigable nearby river.

The two main target areas are Chicken Mountain and Black Creek/Golden Horn. Mineralization is hosted in veins and disseminated sedimentary and volcanic rocks, similar to Fort Knox (Kinross) and Eagle (Victoria Gold), and historic drilling from 1997 returned interesting highlights, like 24.7m at 12.5 g/t Au, 36.6m at 1.36 g/t Au, and 31.7m at 1.28 g/t Au.

When talking to CEO Reda, he got so enthusiastic about Flat that it seemed he and his team actually have the biggest hopes for this project. There are several reasons for this. For starters, Flat is located in the fourth largest placer mining district in Alaska and has a history dating back to 1908. More recently the property was explored by companies like Fairbanks Gold (founded and financed by Robert Friedland), and has 11,000 meters of diamond and RC drilling into it. The main target, Chicken Mountain, hosts a robust 4km long gold-in-soil anomaly where drilling indicated gold mineralization over a kilometer, and is the likely source of the majority of the historic 1.4Moz of placer gold mined in the area. Historical metallurgical data suggests that the gold at Flat could be free milling as well as having untested oxide potential. Tectonic is taking steps to confirm both characteristics and ultimately the potential for heap leaching at the site.

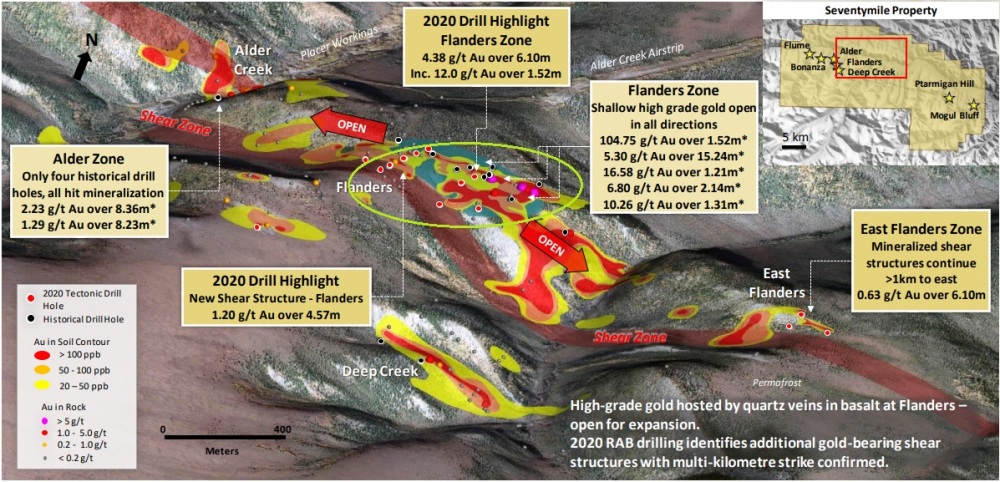

Tectonic’s third project is the Seventymile project, part of an underexplored, fully owned 40km long Greenstone belt, located 270km east of Fairbanks, Alaska. The property is only accessible by air (small aircraft and helicopter), and in the winter by a winter trail.

Seventymile is an orogenic gold system, with lode-style high grade quartz mineralization occurring in shear zones and faults. Drilling highlights are 5.5 g/t Au over 15.0m, 1.1m at 205.9 g/t Au, 6.1m at 2 g/t Au, 19.8m at 1.37 g/t Au, and 6.1m at 4.38 g/t Au.

On a closing note, exploration programs are discussed at the moment between management and their technical team, and will be announced soon, as are the plans for an upcoming, necessary financing.

Conclusion

At a current market cap of just C$9.7M, owning three very interesting gold projects with district potential and a formidable, well-known team at the helm, backed by Alaskan natives and a roster of respected shareholders, Tectonic presents an attractive value proposition. The company is in the midst of formalizing its exploration plans and planning a raise, potentially turning 2022 into a pivotal year for Tectonic Metals, with several chances at large scale discoveries, which could lead to a substantial re-rating.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

This article is also published on www.criticalinvestor.eu. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Tectonic’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Tectonic or Tectonic’s management. Tectonic Metals has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high-quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

The author is not a registered investment advisor, and has a long position in this stock. Tectonic Metals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.tectonicmetals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosures

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Barrick Gold Corp., a company mentioned in this article.